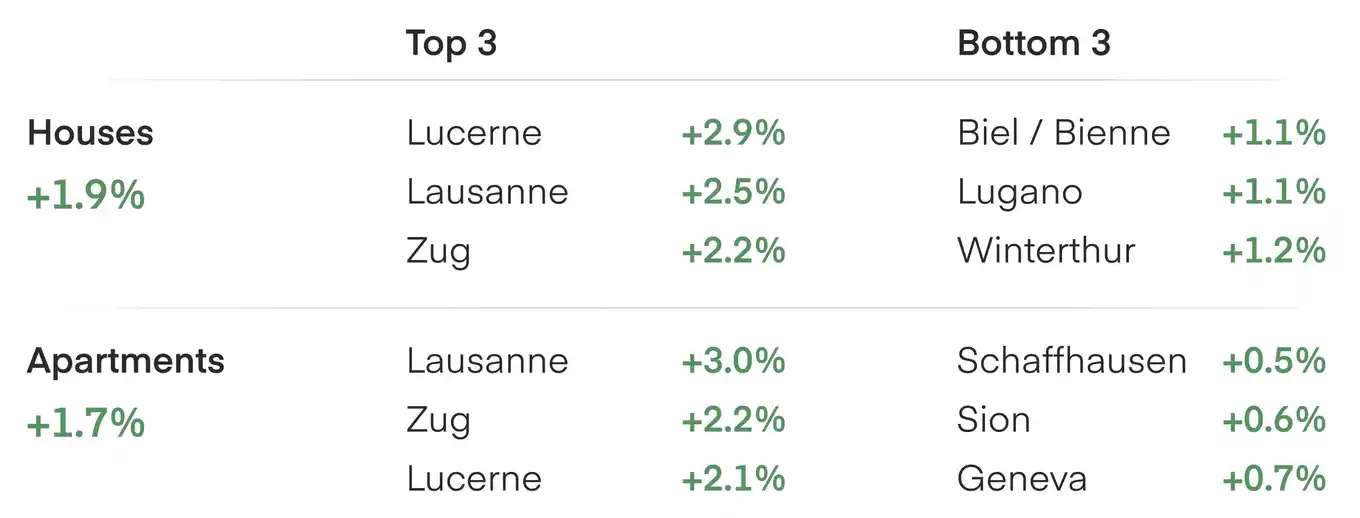

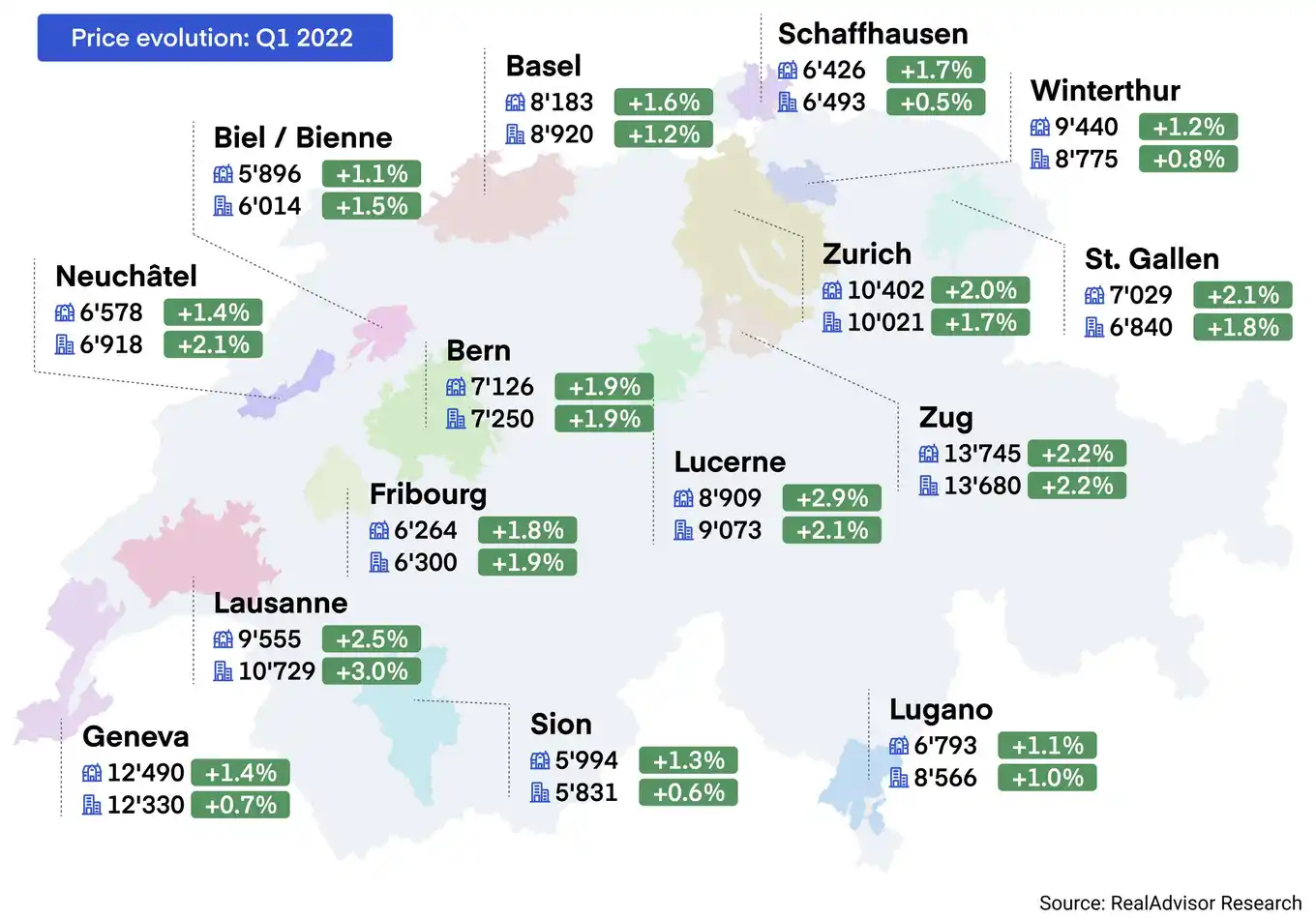

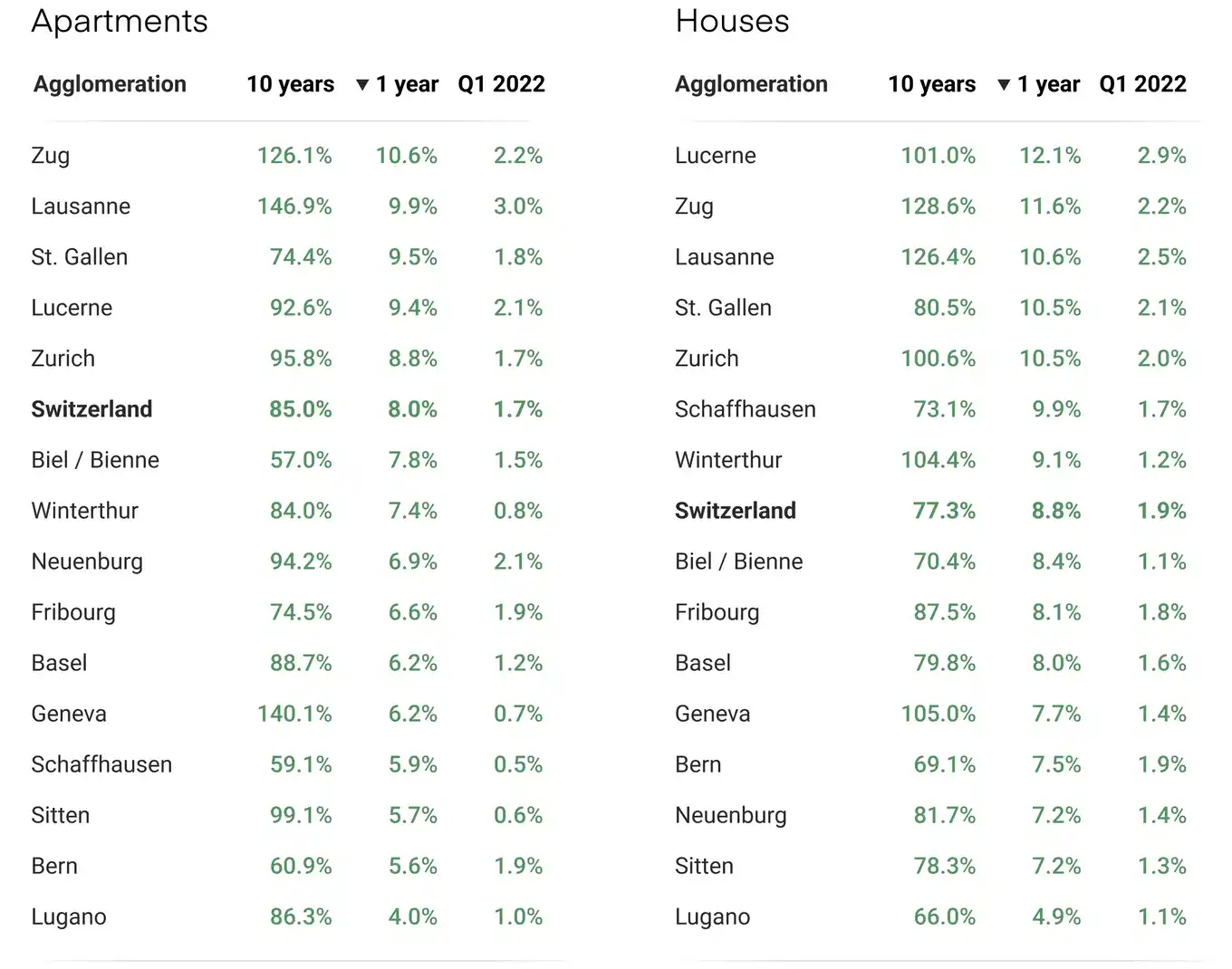

Q1 2022: Prices variation in the 15 largest urban areas

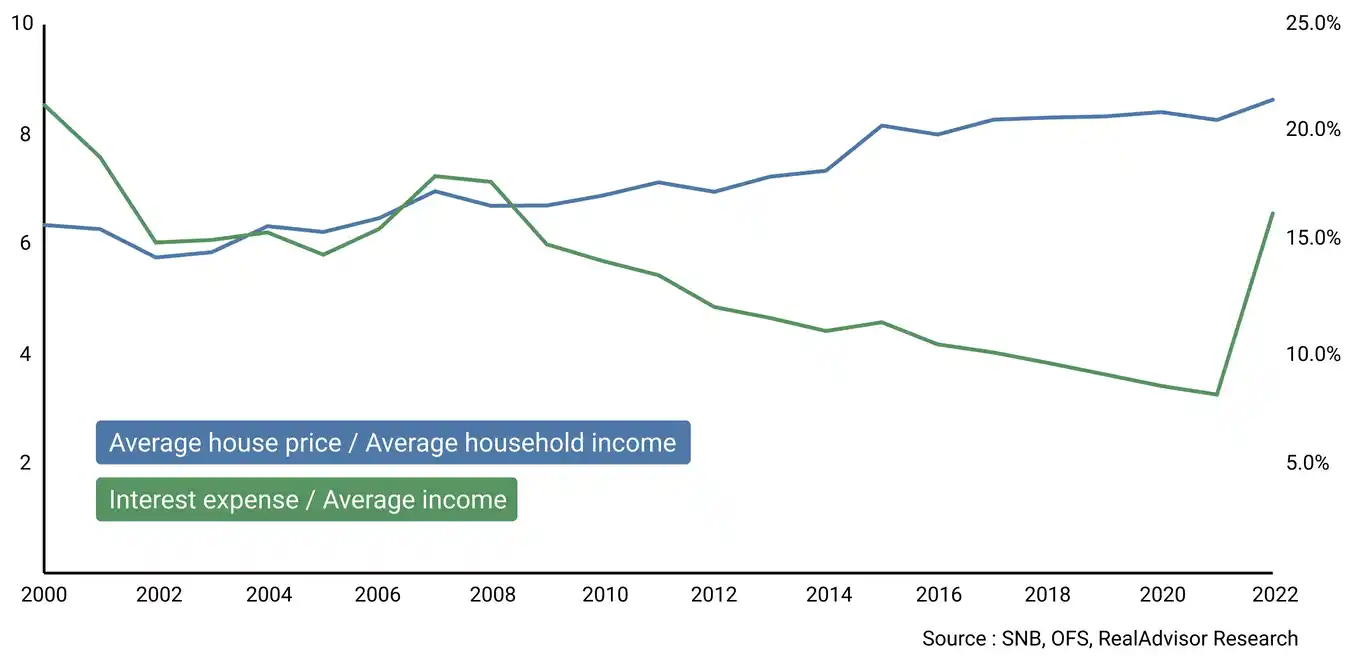

Mortgage interest rates have jumped by more than 150%, but this has not yet been reflected in property prices, which have continued to rise by +1.8% in the first quarter of 2022. Supply is shrinking with the stock of homes for sale continuing to fall at -12% for detached houses and -5% for apartments. For future buyers, the mortgage interest burden has doubled to 16% of the average household income from 8% in 2021.

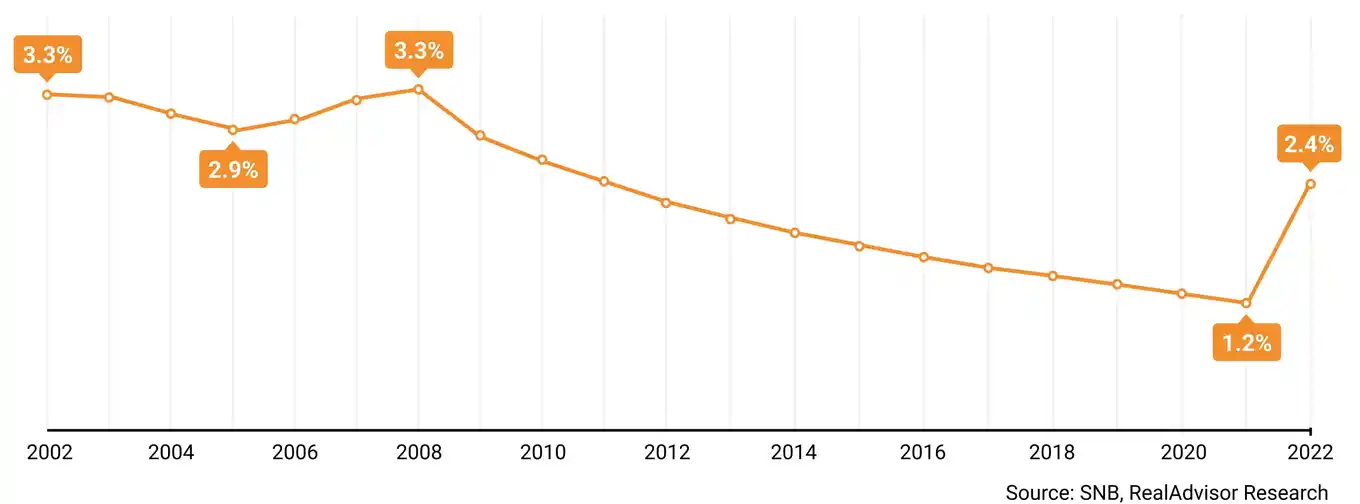

In April, 10-year fixed mortgage rates approached 2.4%, the highest value we have seen in 8 years. Analysts are predicting an upward trend over the next 12 months for long-term fixed rates. We may see some volatility in these figures, as the actions of international central banks are difficult to predict in an uncertain economic climate. Inflation and rising prices are the main causes of this increase. Despite the fact that the SNB forecasts inflation of 2.1% in Switzerland, Europe and the US, the observed annual inflation rate is much higher (7.5%).

In this context, the attractiveness of assets such as real estate is very strong. Property owners are currently the big winners in this situation.

Their debt-to-value ratio has fallen sharply. Those who bought in pre-pandemic times have already, on paper, made an excellent return on their investment.

Demand is therefore strongly supported by potential buyers who feel pressured to take a position. The fear of not being able to afford a house that suits their needs is very real. The stock of houses and flats for sale is at its lowest and properties are only on the market for a short time. Buyers need to be prepared and responsive to secure the right property for them.

Mars 2021 - Mars 2022

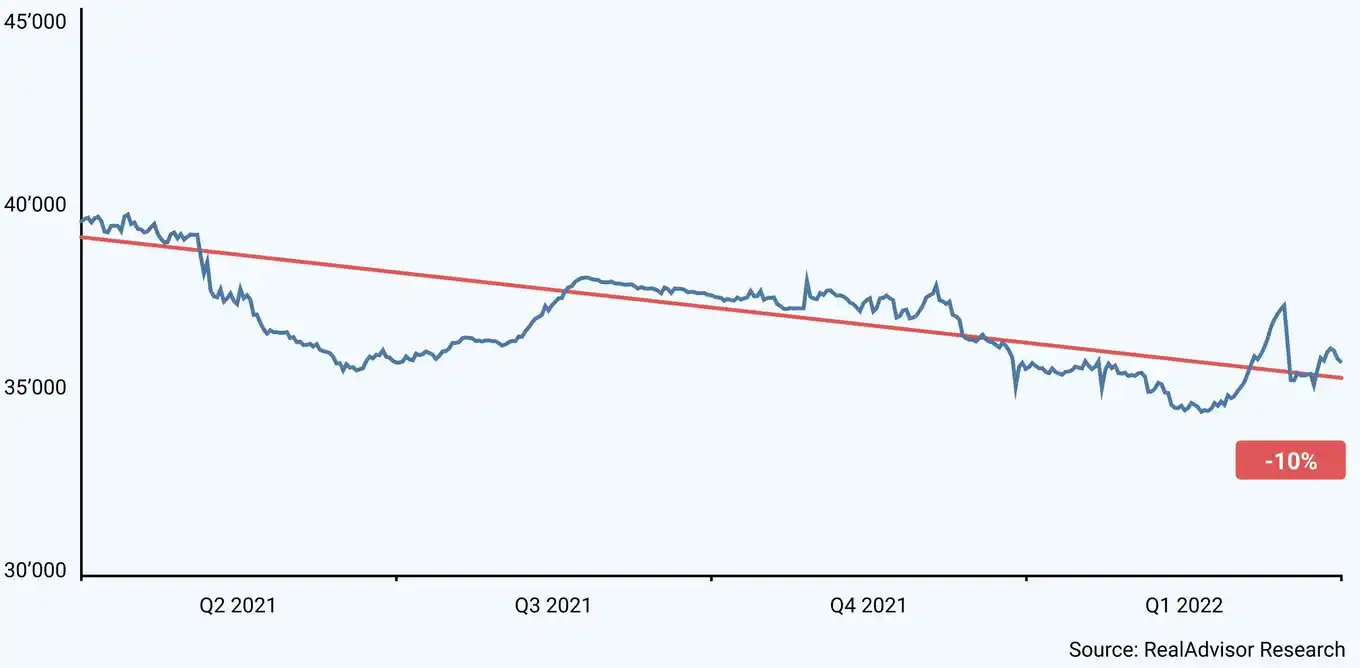

After a record year in terms of transaction volume in Switzerland, the stock continues to decline. In 24 months, the stock of houses for sale has contracted by -18%. During the pandemic, the stock of flats had remained stable, but since the return to normal and the surge in prices, supply has fallen by 13% in 12 months.

The strong demand over the last 24 months, in all property categories - rural and urban - has dried up the supply of properties for sale. Furthermore, in such a tight market, a significant number of transactions are done "off-market" and never appear online. In the canton of Zurich, we were already seeing this phenomenon in 2021.

At the end of the year, there were only 1,150 listings online, while around 7,000 properties were sold in the whole year.

If the stock were to continue to fall at this rate, this could counteract the rise in interest rates and thus keep prices high in areas with a shortage of properties for sale.

It is clear that affordable single-family homes have been particularly popular with buyers, as the supply in suburban and rural areas close to the big cities has become almost non-existent. In the Gros de Vaud district, for example, there are less than 100 houses on the market. This is also evident in Aargau, close to the Zurich agglomeration. In the districts of Bremgarten or Baden, there are fewer than 100 villas for sale at the moment.

Rising house prices and interest rates have a strong impact on the share of income that future homebuyers will need to allocate to their homes. Based on the average income of Swiss households and the average price of a house, the share of interest on income has doubled from 8% to 16% in less than 6 months.

This development will not affect the borrowing capacity of buyers, as financing institutions have not yet revised their loan conditions, which are based on a theoretical rate of 5%. On the other hand, this new situation weighs in the balance for those who plan to invest. For those who can afford it, the calculation has been simple for several years now, as the monthly costs of owning a property are lower than the costs of renting.

In many cases today, if you add the interest charge to the maintenance costs, the total cost will often be higher than rent for an equivalent property. On the other side of the balance, the tax deductions and the potential for capital gains make the purchase of real estate very attractive. In fact, if we look back 20 years, buying a property was a similar burden for a household, with rates in excess of 3%. For those who bought at that time, it was probably one of the best investments available, which today represents a return of 5 to 10 times the equity depending on the region.

RealAdvisor is the commercial brand of the legal entity "AI Partners SA", a limited company headquartered in Geneva.

RealAdvisor

c/o AI Partners SA

Avenue Louis-Casaï 86A

1216 Cointrin

Switzerland