Q1 2023: Price changes in the 15 largest urban areas

In Q1 2023, the Swiss real estate market is experiencing a slowdown, with transaction numbers dropping by 17% and prices declining in key cities. Despite modest growth in single-family home prices, the overall stagnation and decreased listing prices suggest a potential shift towards a buyer's market. As inflation remains at 2.9% and interest rates rise, uncertainty looms over the market.

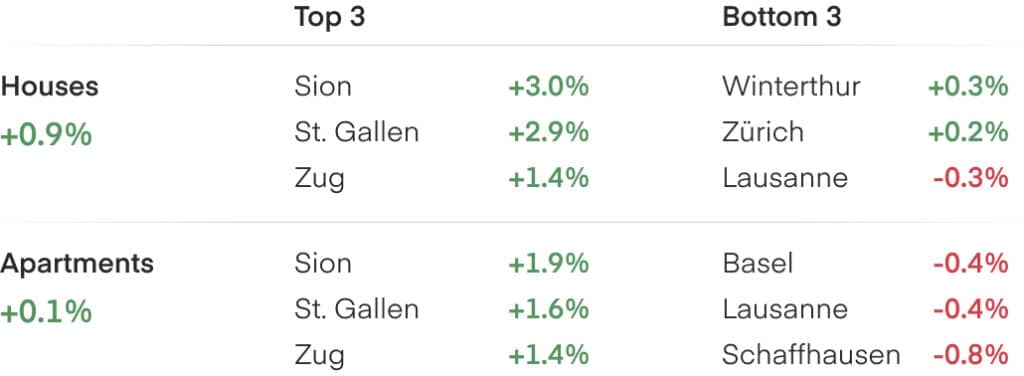

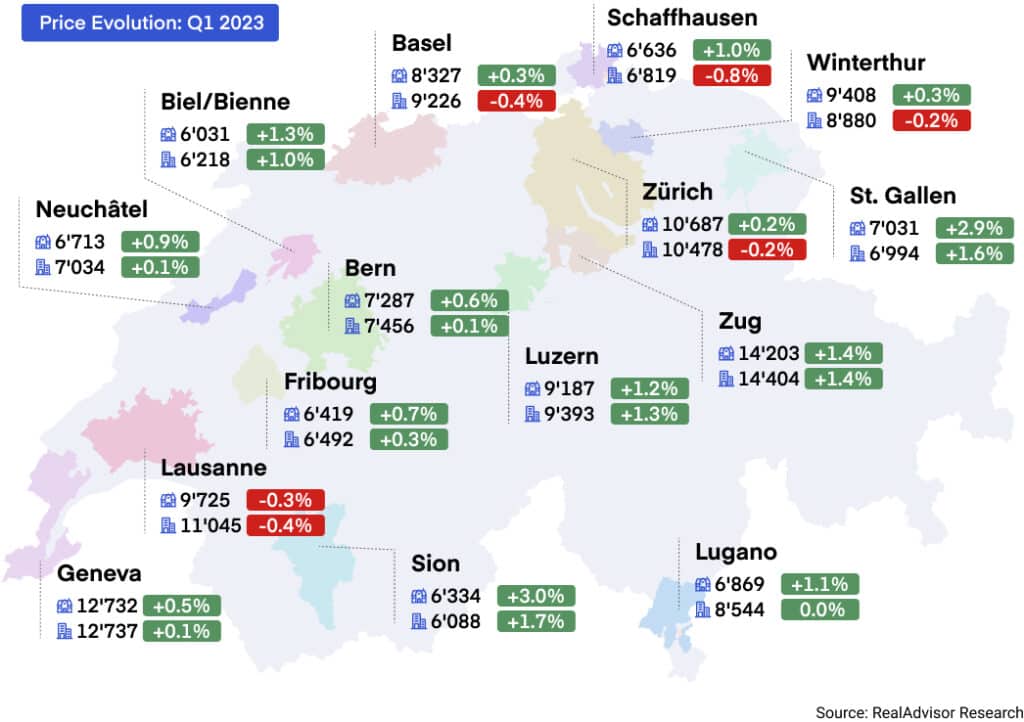

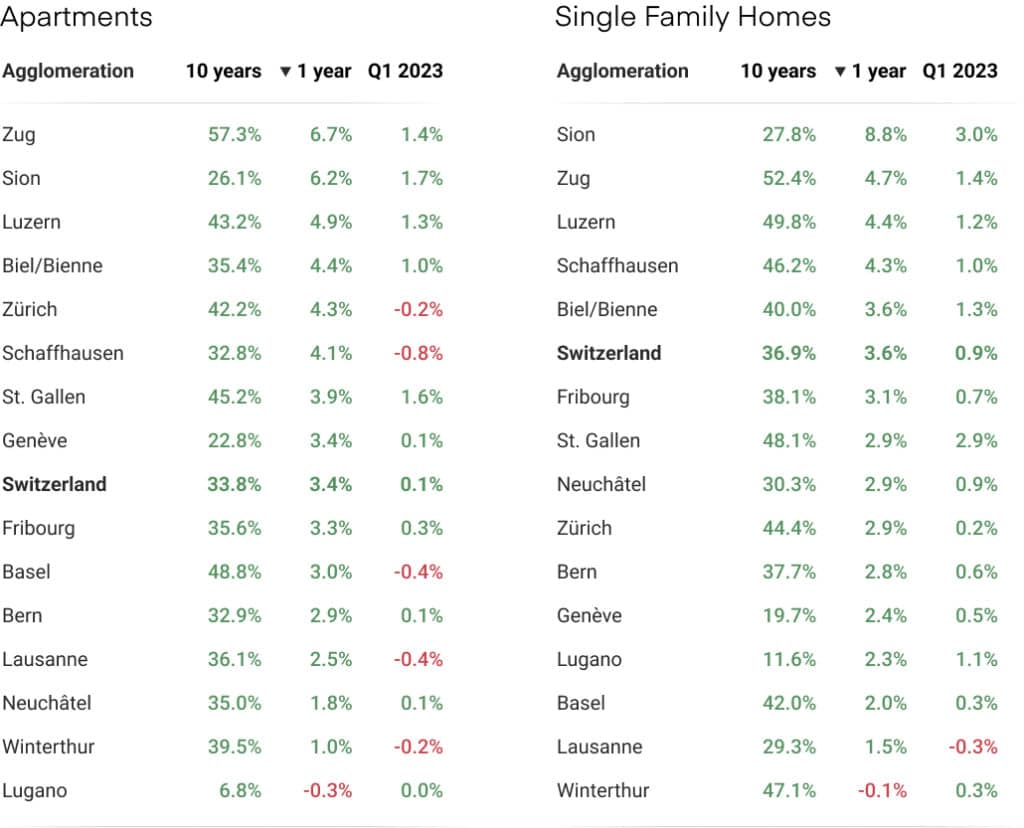

In Q1 2023, apartment prices in key Swiss metropoles such as Zurich (-0.2%), Basel (-0.4%), Lausanne (-0.4%), Geneva (+0.1%) and Bern (+0.1%) have shown signs of stagnation or even decline. These drops in apartment prices highlight potential concerns for investors and homeowners in these urban centres.

In contrast, house prices in these key cities demonstrated modest growth, with increases in Geneva (+0.5%), Zurich (+0.2%) and Basel (+0.3%). However, Lausanne saw a small drop of 0.3%, indicating that the single-family home market may also be facing headwinds in some areas.

Outliers in the Swiss real estate landscape include cities like Sion (+1.7%), St. Gallen (+1.6%), Zug (1.8%), Luzern (+1.3%), Biel (+1.0%), and Fribourg (+0.3%), where apartment prices are still increasing.

Across the whole Swiss market, the number of real estate transactions has experienced a significant decline of 17% in Q1 2023, reflecting the market slowdown across various regions.

Zurich (-14%), Basel (-30%), and Bern (-25%) have also experienced declining transaction numbers. This downward trend in transactions may reflect a stand-off between sellers who are not ready yet to lower their prices and buyers who aren’t willing to pay or able to finance these high asking prices.

Touristic regions such as Grisons and Valais are not immune to the slowdown, with Grisons experiencing a 36% decline in transactions.

In Romandie, the landscape is split, with transaction numbers dropping in the canton of Geneva (-21%) but seemingly still increasing in Vaud (+17%) and Fribourg (+7%). These contrasting numbers are difficult to explain at this stage and might be outliers.

Switzerland's key cities, including Zurich (-0.7%), Geneva (-1.3%), Lausanne (-0.7%), and Basel (-1.3%), have seen listing prices trend downward in Q1 2023, with asking prices around 1% lower compared to the previous quarter. The downward trend in listing prices could indicate that sellers are adjusting their expectations in response to the slowing market.

This adjustments may lead to increased buyer interest and potentially a change in the balance of power between buyers and sellers. However, supply is still very low, with currently only around 35’000 listings for sale in Switzerland. In the canton of Zurich for example, there are only around 1’800 objects for sale for 1.6 million inhabitants.

Switzerland is currently experiencing an inflation rate of 2.9%, and interest rates on 10-year fixed mortgages have surpassed 3%. Opinions on whether the Swiss National Bank (SNB) and the Federal Reserve will continue to raise interest rates remain divided, contributing to market uncertainty.

Transaction prices typically lag 3 to 6 months behind listing prices, and the current downward trend in asking prices could signal an impending decrease in transaction values. This potential decline may present opportunities for well-positioned buyers.

Although the number of transactions has already dropped to levels last seen 20 years ago, it remains uncertain whether the trend will continue in the coming months. Investors and homebuyers should closely monitor market developments and adjust their strategies accordingly, as the Swiss real estate landscape undergoes these shifts.

In conclusion, the Swiss real estate market in Q1 2023 is experiencing a slowdown, with transaction numbers decreasing and prices stagnating or declining in key cities. While this may hint at a potential shift towards a buyer's market, uncertainties related to inflation and interest rates make it crucial for stakeholders to stay informed and adapt their strategies to the changing market dynamics.

RealAdvisor SA

Rte de Saint-Julien 198,

CH-1228 Plan-les-Ouates

RealAdvisor AG

Heinrichstrasse 200

CH-8005 Zürich