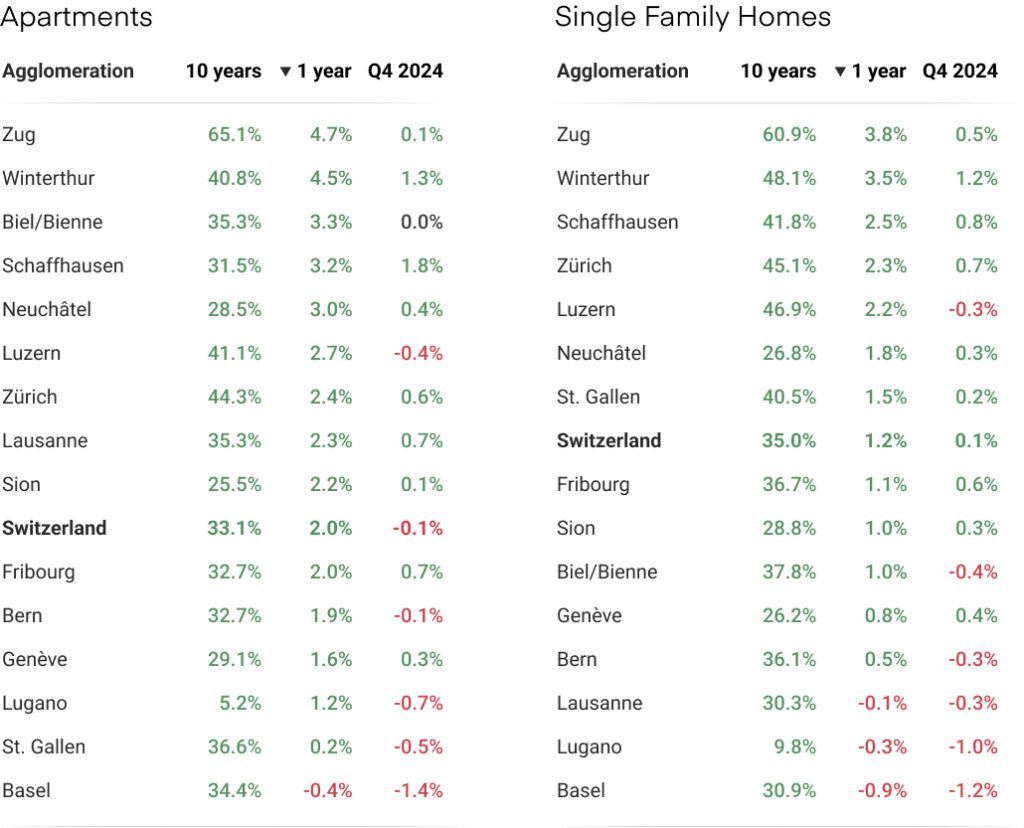

Q4 2024: Price changes in the 15 largest urban areas

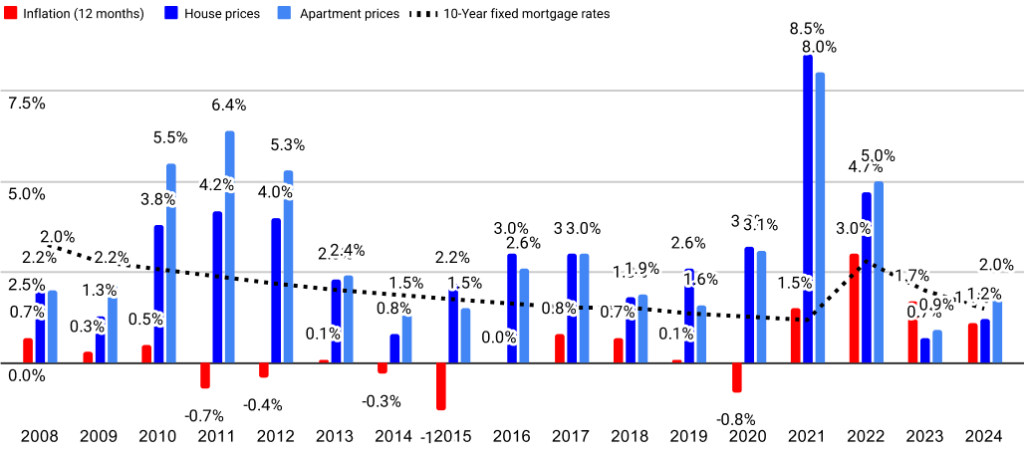

In 2024, Swiss property prices registered modest growth, with apartment prices increasing by +2% and single-family homes by +1.2% year-over-year. However, transaction volumes continued their decline for the third year in a row, reflecting cautious buyer behavior despite improved affordability due to lower interest rates. As 2025 begins, long-term rates are expected to stabilize, and prices are anticipated to grow moderately. Nonetheless, transaction volumes are likely to remain below historical levels.

In 2024, property prices continued their upward trend, confirming a positive dynamic compared to 2023. Apartment prices increased by +2%, more than double the +0.9% growth observed in 2023. Single-family homes recorded a +1.2% increase, compared to +0.7% the previous year. These gains represent a return to real price growth after accounting for inflation, which stood at 1.1%. This transition contrasts sharply with 2023, when inflation outpaced nominal property price increases.

The year began with strong momentum, especially in the first two quarters, which saw price increases in nearly all regions. However, the second half of the year experienced a significant slowdown, with prices stabilizing or declining in several areas. Notable trends include the continued decline of prices in Basel for the second consecutive year. Meanwhile, Ticino, which was among the top-performing cantons in 2023, dropped to the bottom of the rankings in 2024, with a -0.2% decrease for single-family homes and a limited +0.5% increase for apartments.

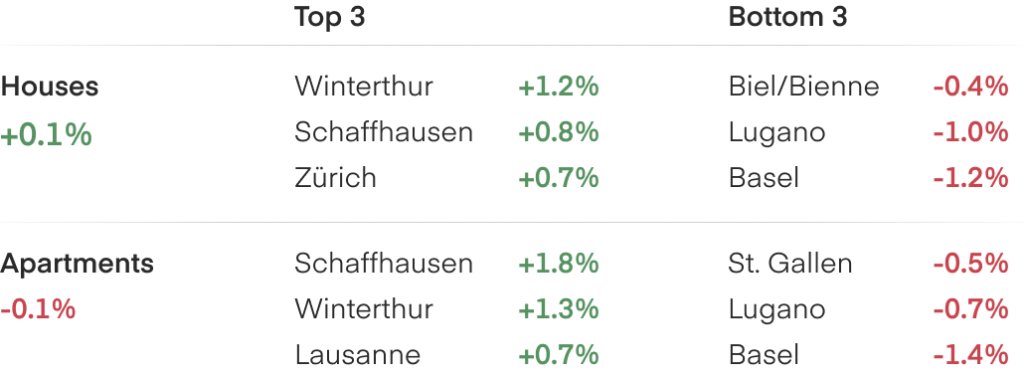

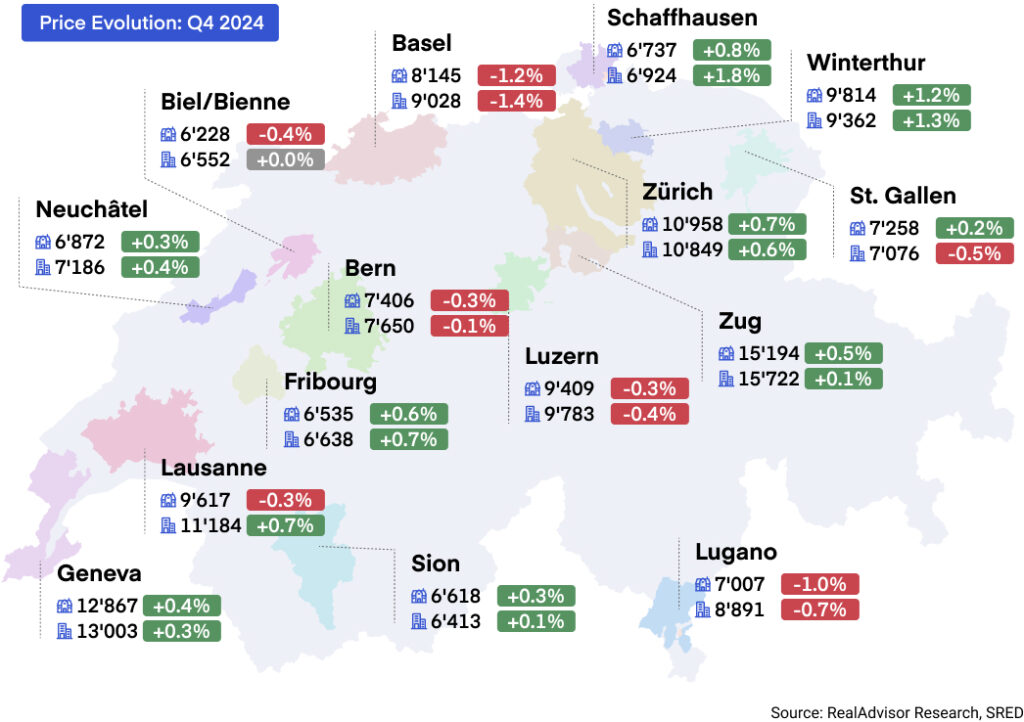

Despite annual improvements, the fourth quarter of 2024 saw the slowest price growth of the year. Apartment prices fell slightly by -0.1%, while single-family homes recorded only a marginal increase of +0.1%. The first half of the year had experienced uniform growth, but Q4 highlighted significant regional disparities. Cities such as Schaffhausen (+1.8%), Winterthur (+1.3%), and Lausanne (+0.7%) led apartment price growth. Conversely, Lugano (-0.7%), Lucerne (-0.4%), and St. Gallen (-0.5%) saw declines.

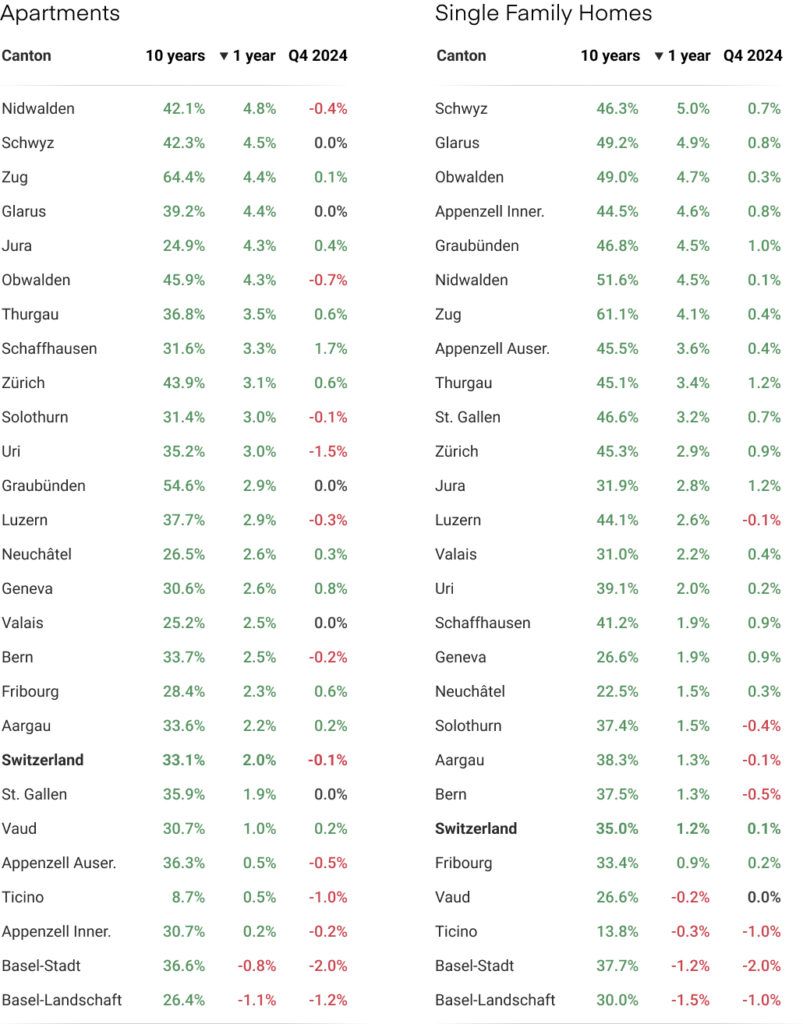

Regional disparities were more pronounced at the cantonal level in the final three months. For apartments, Schaffhausen (+1.7%), Geneva (+0.8%), Zurich (+0.8%), and Fribourg (+0.6%) saw the strongest growth. In contrast, Basel-Stadt (-2.0%), Uri (-1.7%), and Basel-Landschaft (-1.2%) posted significant declines. For single-family homes, cantons such as Jura (+1.2%), Thurgau (+1.2%), and Geneva and Schaffhausen (+0.9%) showed solid gains, while Basel-Stadt (-2.0%) and Basel-Landschaft (-1.0%) continued to face challenges.

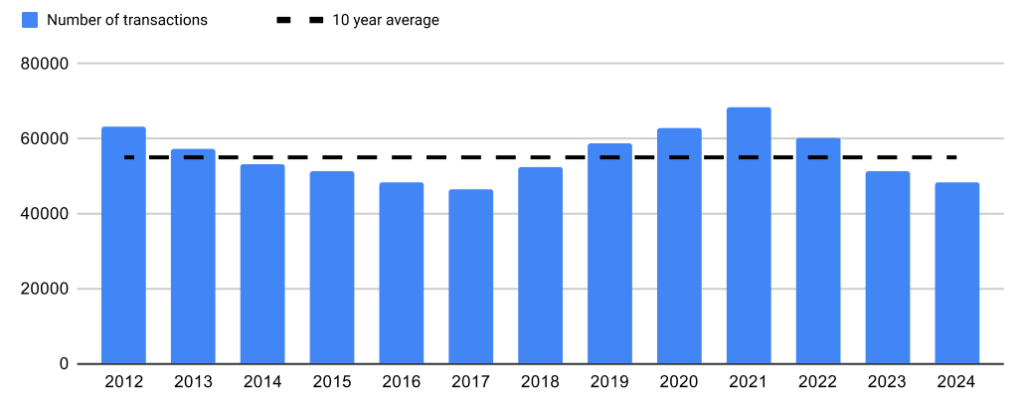

Transaction volumes in Switzerland followed a downward trajectory in 2024, decreasing by 6% compared to the previous year. This marks the third consecutive year of contraction, with activity levels significantly below the 10-year historical average. The gap is particularly striking compared to the peak in 2021. Despite reduced financing costs due to successive interest rate cuts throughout 2024, transaction volumes have not yet rebounded. Although demand shows early signs of stabilization, this has not translated into a meaningful recovery in activity.

Geneva exemplifies the structural challenges facing the broader Swiss market. The canton recorded only 376 property transactions in Q3 2024—a 31% year-on-year decline and the lowest quarterly figure in over a decade. This steep drop was a recurring theme throughout the year, with quarterly YoY declines of 3% in Q1, 22% in Q2, and 31% in Q3. However, provisional Q4 data suggests some improvement, hinting at a potential positive trend heading into 2025.

Supply increased slightly in 2024, with 45,000 residential properties available for sale by year-end, up 5% from 43,000 in December 2023. Online listings have returned to pre-pandemic levels, reversing the sharp declines observed between 2020 and 2022. However, this growth remains measured, constrained by limited new construction activity and the withdrawal of unsold properties from the market.

Properties are taking longer to sell, with single-family homes and apartments now staying on the market 40% longer than two years ago. This reflects cautious buyer behavior and a broader market slowdown. The reduction in new construction activity has further limited inventory growth, particularly in the single-family home segment.

A year ago, in our Q4 2023 barometer, we predicted that the Swiss National Bank (SNB) would lower interest rates, based on the inverted yield curve and the SNB’s persistent efforts to mitigate the strength of the Swiss franc. Consequently, we anticipated faster property price growth and a rebound in transaction volumes.

In retrospect, while we were correct about interest rates and prices, transaction volumes fell to their lowest level since we began tracking, despite an 8% population growth over the past decade.

Over the past month, long-term yields on sovereign debt have risen across Western markets, notably in the United States and the United Kingdom. The yield curve for the Swiss franc has since “de-inverted,” and mortgage rates have started to rise slightly. Consequently, we no longer anticipate a significant reduction in interest rates. We remain cautious and expect Swiss real estate prices in 2025 to track inflation.

There are few signs that the current standoff between buyers and sellers will ease soon. Even if mortgage rates remain stable or drop slightly, they are expected to stay low, making homeownership more affordable than renting. However, unchanged lending rules and access to financing mean we do not foresee a significant rise in the number of potential buyers.

Low interest rates alone will not address today’s supply constraints. As long as new construction volumes are held back by increasingly complex and time-consuming building permit processes, which are unlikely to improve in the short term, transaction volumes are unlikely to increase significantly. As a result, we expect 2025 to mirror 2024’s trends: low transaction volumes and modest price growth.

RealAdvisor SA

Rte de Saint-Julien 198,

CH-1228 Plan-les-Ouates

RealAdvisor AG

Heinrichstrasse 200

CH-8005 Zürich