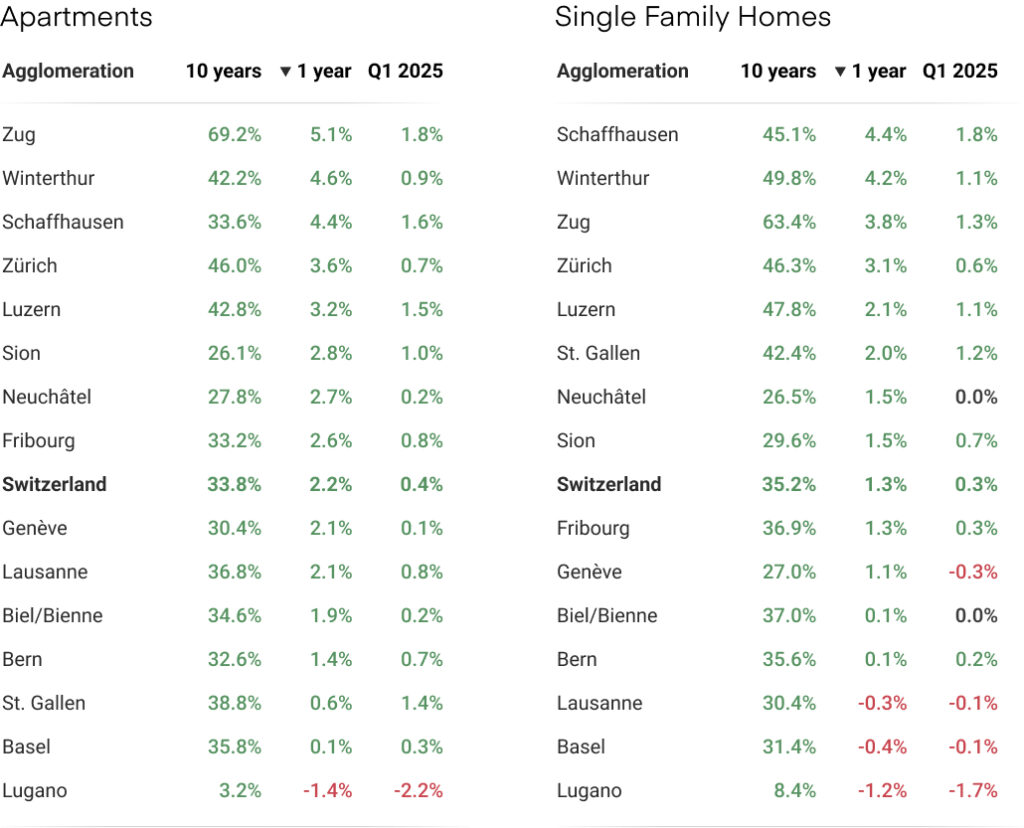

Q1 2025: Price changes in the 15 largest urban areas

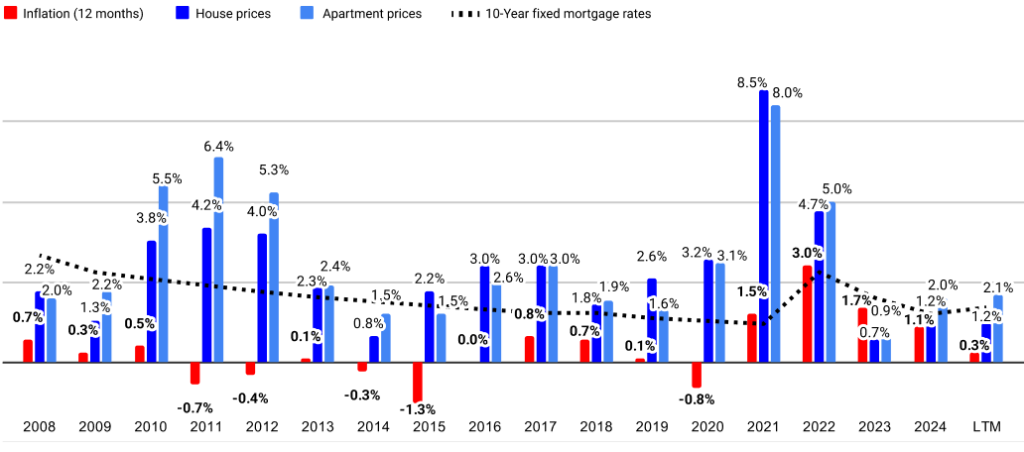

In the first quarter of 2025, real estate prices in Switzerland continued their modest upward trend: apartment prices increased by +0.4% and single-family home prices by +0.3%. Despite attractive mortgage rates, transaction volumes remain historically low, held back by tight financing conditions and limited new construction activity.

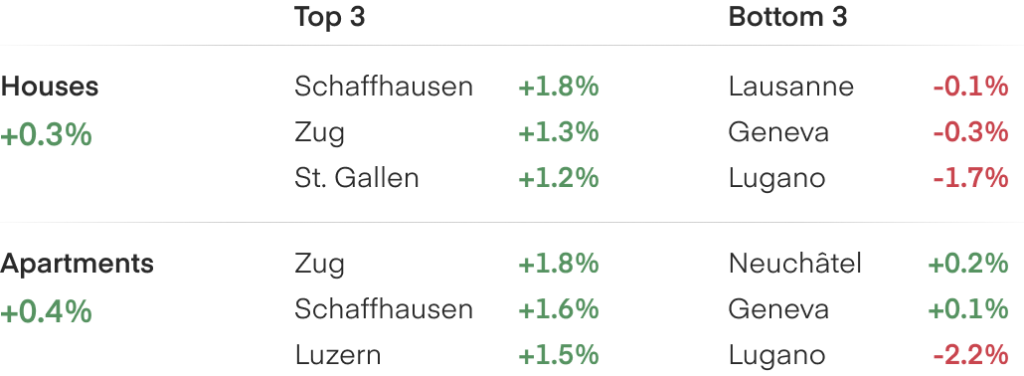

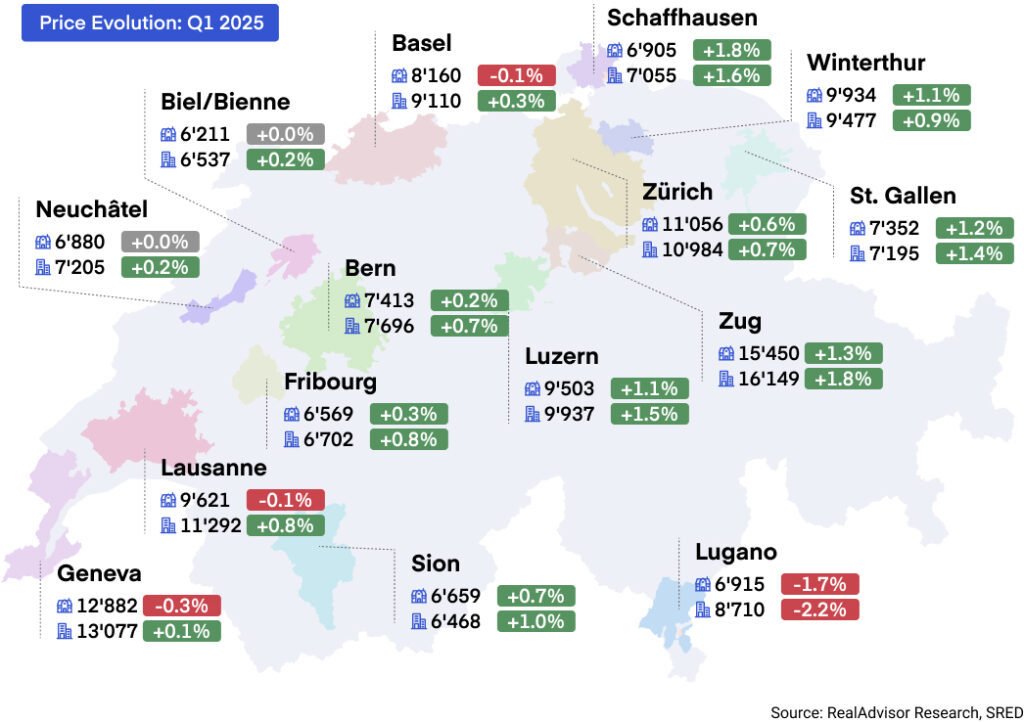

Among the major cities, Zug and Schaffhausen posted the strongest quarterly growth in apartment prices, each rising by +1.8%, followed by St. Gallen (+1.5%), Lucerne (+1.2%), and Winterthur (+1.2%). In the single-family home segment, the largest increases were also recorded in Schaffhausen (+1.8%), Zug (+1.3%), St. Gallen (+1.2%), and Winterthur (+1.1%).

At the other end of the spectrum, Lugano experienced the sharpest declines: –2.2% for apartments and –1.7% for houses. Along the Lake Geneva arc, prices remained relatively stable, with only slight changes: apartment prices edged up in Geneva (+0.1%) and Lausanne (+0.2%), while house prices dipped marginally (–0.3% in Geneva and –0.1% in Lausanne).

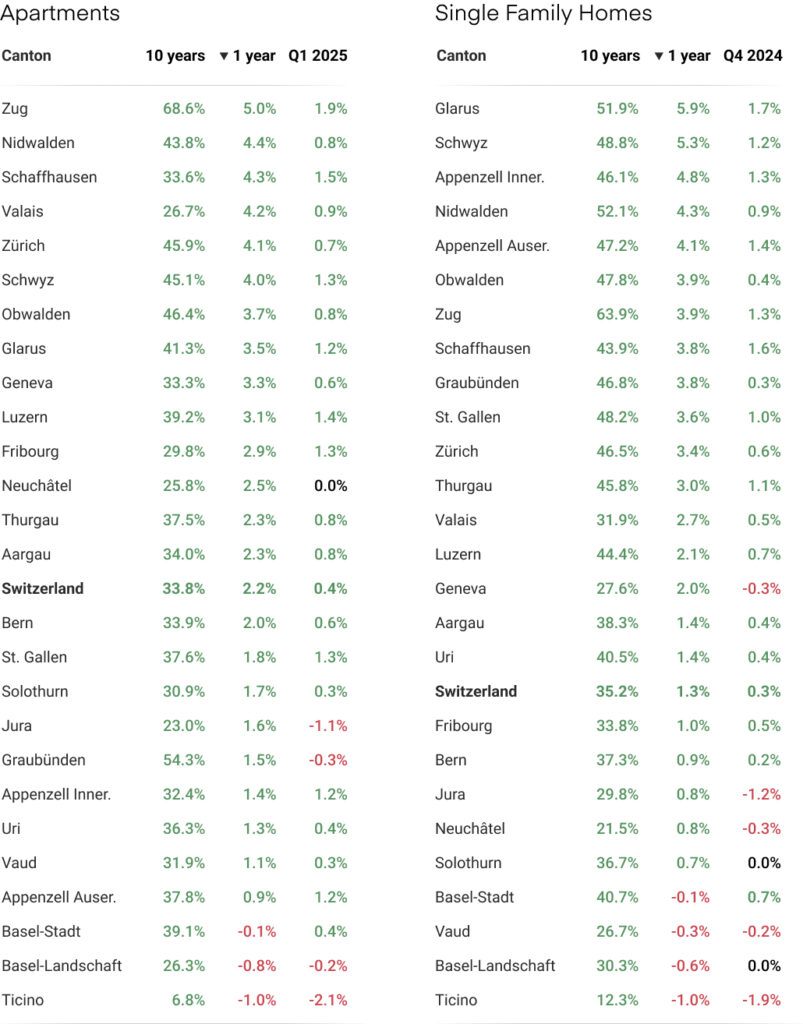

At the cantonal level, Zug again led the way with apartment prices up +1.9% and house prices up +1.3%. It was followed by Schaffhausen (+1.5% for apartments and +1.6% for houses), Lucerne (+1.4%, +0.7%), and Appenzell Ausserrhoden (+1.2%, +1.4%). In contrast, Ticino recorded a sharp decline (–2.1% for apartments, –1.9% for houses), while Jura, Graubünden, and parts of Basel also saw price drops due to weak demand and persistent structural challenges.

Nationally, apartment prices slightly outpaced those of single-family homes over the past quarter (+0.4% versus +0.3%). This gap has narrowed compared to the past twelve months, during which apartments rose +2.2% and houses +1.3%.

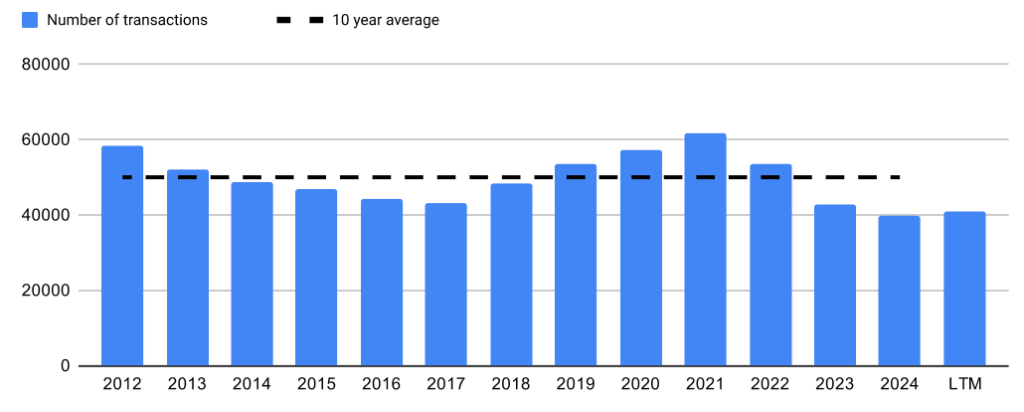

After three consecutive years of decline, real estate transaction volumes in Switzerland stabilized in 2024, though they remain well below historical averages. A modest nationwide rebound was observed, but the market remains far from pre-2020 levels.

Trends vary significantly across cantons. Zurich saw a notable recovery in transaction volumes in 2024 after a particularly weak 2023. Conversely, Geneva posted another decline, reaching its lowest level in over a decade.

Persistently low transaction levels are not solely due to affordability issues. Although prices have outpaced income growth, historically low mortgage rates continue to support strong demand. The main bottleneck remains supply: new construction is insufficient, and owners rarely list their properties. In Switzerland, the average holding period for residential real estate is about 30 years—over 50 years in Zurich. By comparison, the average in France is closer to 7 years.

Construction activity remains too low to meet demand. While the number of building permits rose in 2024, many projects are delayed by administrative hurdles and frequent objections. In addition, new Basel III banking regulations could make it more difficult for developers to secure financing. However, according to the Swiss Contractors Association, residential construction is expected to increase slightly in 2025, ending a streak of five consecutive quarters of decline.

The first quarter of 2025 broadly aligns with our expectations: modest price growth, similar to that seen in 2024, and transaction volumes still below the historical average. We had anticipated that 10-year fixed mortgage rates would not fall significantly—and they have, in fact, risen slightly since January.

Since our last barometer in December, one key factor has changed: the Swiss National Bank (SNB) lowered its policy rate to 0.25% in response to subdued inflation, which now sits around 0.3%.

This move caused a slight dip in variable mortgage rates, while fixed rates have since climbed back to around 1.7% for 10-year terms. The SNB still has some room to maintain an accommodative monetary policy, but further rate cuts appear unlikely in the short term.

The global macroeconomic environment has grown more complex since late 2024. Could this affect the Swiss real estate market? Long-term interest rates have risen sharply across Western markets, fueled not only by structural fiscal deficits but also by growing geopolitical tensions and a resurgence of U.S. protectionism under the new administration. The announcement of new tariffs surprised markets and drove up bond yields, pushing up borrowing costs for both governments and companies, as investors now demand higher returns for long-term lending.

These developments could affect the Swiss real estate market in two key ways. First, they may limit further declines in mortgage rates, especially if international long-term rates remain elevated.

Second, they increase the risk of imported inflation—particularly as the Swiss franc has weakened slightly since the beginning of the year. Both factors should be monitored closely, as they directly influence long-term mortgage rates and, ultimately, household purchasing power.

We expect trade tensions initiated by the U.S. to ease gradually, along with a more accommodative stance from the Federal Reserve. A potential rate cut by the Fed—publicly supported by President Trump—could reduce pressure on global long-term yields and help stabilize or even ease financing conditions in Switzerland.

Despite these global risks, the domestic market remains relatively stable. Price growth is moderate and in line with expectations, but transaction volumes have yet to recover. Supply continues to fall short of structurally strong demand: new construction remains insufficient, resale listings are scarce, and credit standards remain tight. Although more building permits were issued in 2024, projected completions for 2025 are still expected to fall short of market needs.

We therefore maintain our forecast for moderate price growth between +1% and +2% for the full year 2025.

RealAdvisor SA

Rte de Saint-Julien 198,

CH-1228 Plan-les-Ouates

RealAdvisor AG

Heinrichstrasse 200

CH-8005 Zürich