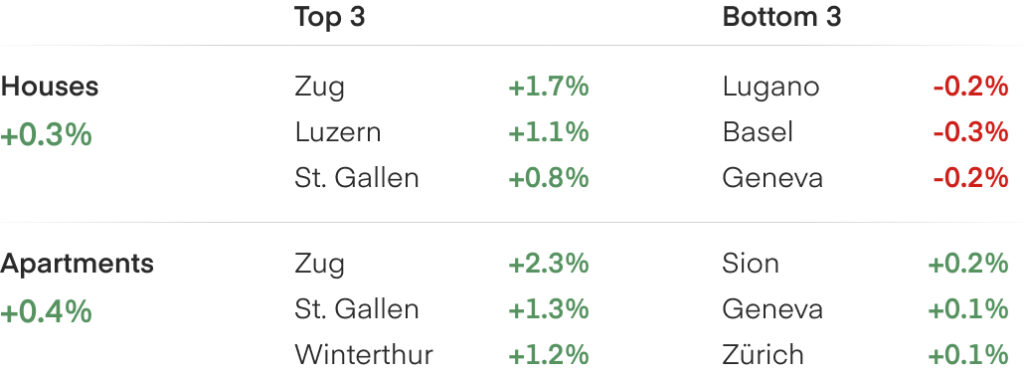

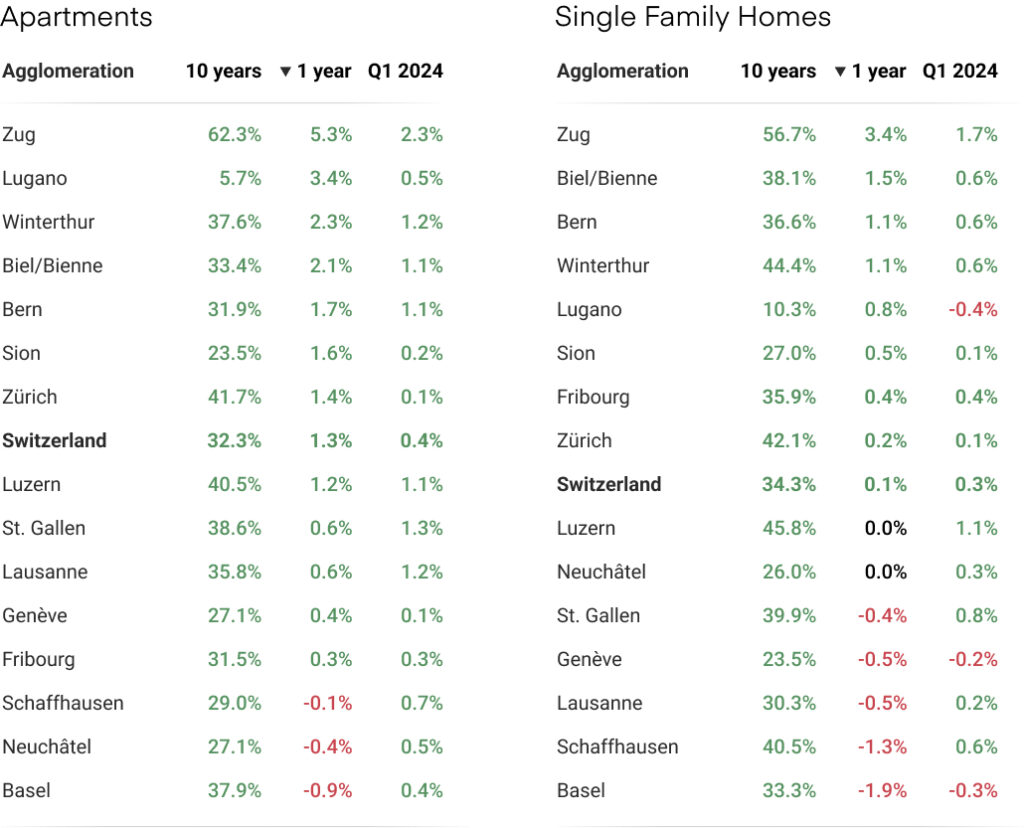

Q1 2024: Price changes in the 15 largest urban areas

Swiss real estate demonstrates resilience, with modest growth and stabilizing transactions in the 1st quarter of 2024.

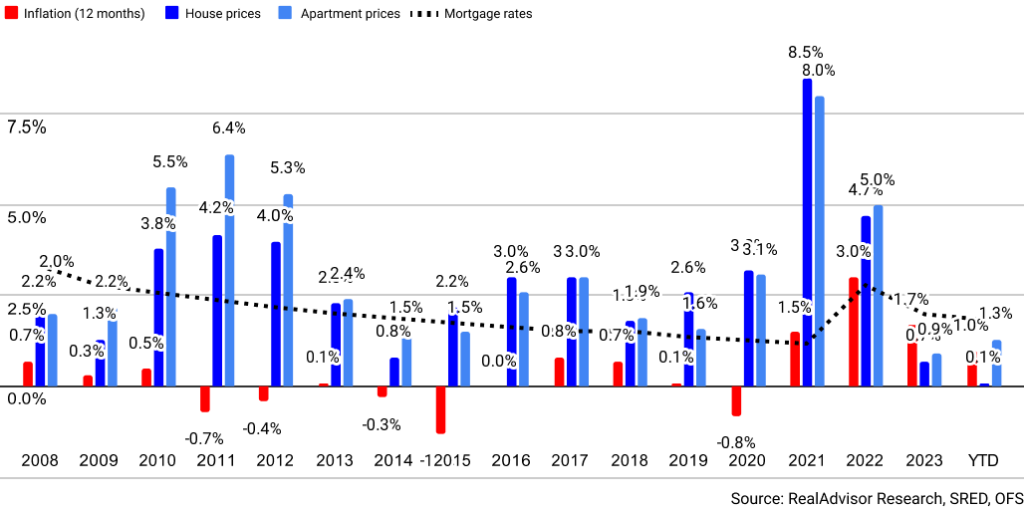

The Swiss real estate market demonstrated its resilience during the first quarter of 2024, with property prices growing modestly amidst challenging global conditions: +0.3% for houses and +0.4% for apartments since January. Key indicators are positive, with reduced interest rates and stable transaction volume. However, the increase in prices over the past 12 months is still well below the 20-year historical average of +3% yearly growth.

Over the last twelve months, the Swiss real estate market has shown slow but positive signs of recovery. Overall, house prices have remained stagnant with a nominal increase of 0.1%, while apartment prices have fared slightly better, achieving a 1.3% rise. As a reference, the average yearly growth of property prices over the last 20 years has been over +3%. The recent quarter shows slight improvements, which translated to a quarterly increase of 0.3% for houses and 0.4% for apartments in the first three months of the year.

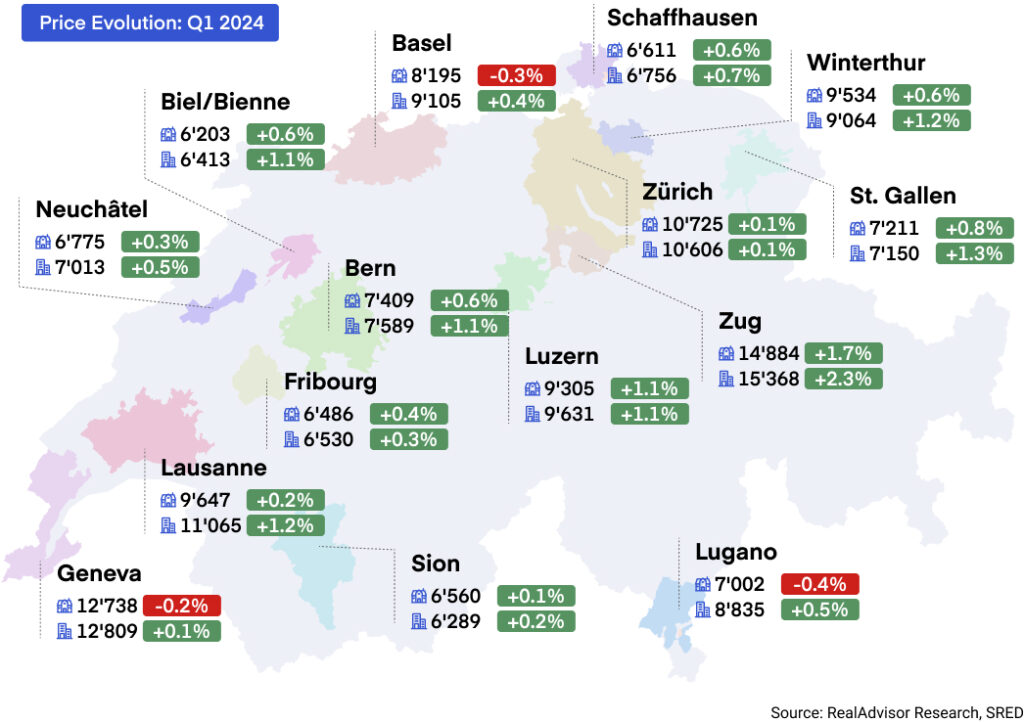

An in-depth analysis of the largest Swiss agglomerations presents a varied landscape in real estate price movements during the quarter. In the apartment sector, Lausanne led with a notable increase of +1.2%, while Bern also showed strong growth with a rise of +1.1%. These cities contrast with the more stagnant markets of Geneva and Zürich, where apartment prices barely moved, registering a minimal increase of only +0.1%. Basel showed a modest improvement, with apartment prices rising by +0.4%.

The market for houses tells a different story, reflecting a more challenging environment. Geneva and Basel experienced declines in house prices, decreasing by -0.2% and -0.3% respectively.

Conversely, Bern and Zürich saw increases in house prices, albeit modest, with Bern achieving a +0.6% rise and Zürich a slight increase of +0.2%. Lausanne faced a more significant drop of -0.5%. These trends indicate that apartments have generally outperformed houses in these urban centres since the end of the pandemic.

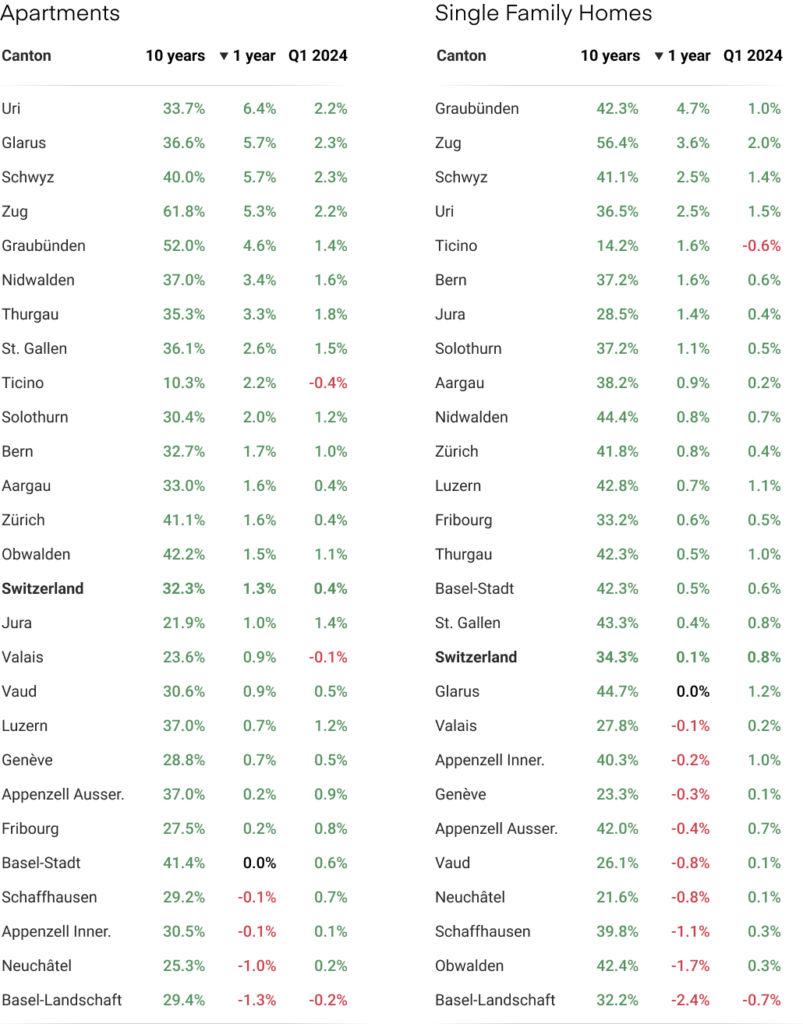

In stark contrast to other regions, low-tax cantons in Switzerland such as Zug, Schwyz, Uri, and Glarus are significantly outperforming the market. These cantons attract more companies and individuals due to their favourable tax policies, especially as global trends lean towards higher inflation and more stringent tax regulations. In the first quarter of 2024, real estate appreciation in these areas was notable: Zug (+2%), Uri (+1.5%), and Schwyz (+1.4%) led in house price increases, while Glarus (+2.3%) and Schwyz (+2.3%) saw the highest rises in apartment prices. These results point to the attractiveness of investing and relocating in regions that offer fiscal benefits.

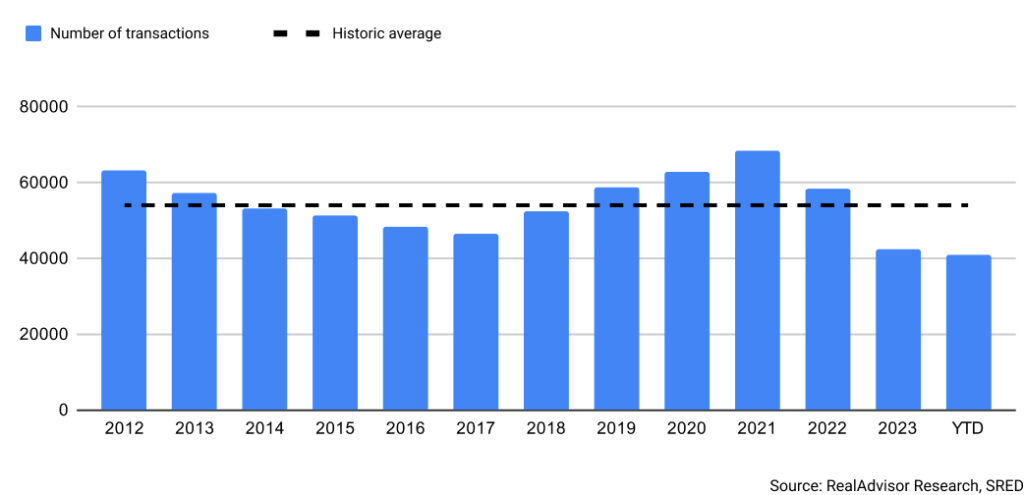

After having significantly dropped following the sharp rise in interest rates, the number of real estate transactions in Switzerland shows signs of stabilizing, with only a slight decrease of -3% nationally over the last 12 months. In Geneva, transaction numbers followed a similar trend, decreasing by -2%.

The recent reduction in interest rates by the Swiss National Bank has not yet significantly impacted transaction activity. However, we expect that this could have a positive effect in the coming months. Indeed, with most banks offering 10-year mortgage interest rates below 2%, the economics of homeownership have again become very attractive for buyers in most regions.

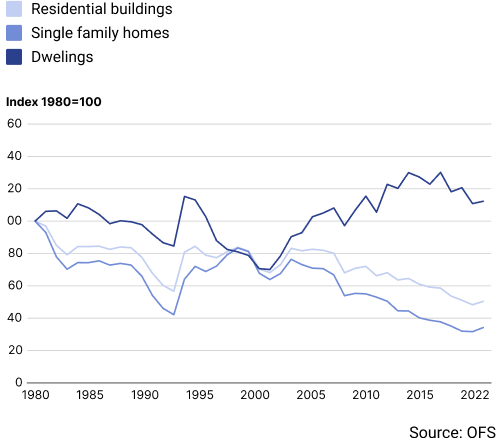

Although buyers have gained some leverage due to increased supply and reduced competition, the overall scarcity of properties has helped maintain price levels. Achieving consensus on price remains difficult, prompting some owners to lease their properties rather than sell at a lower-than-desired price. This, in addition to a reduction in construction activity since 2021, explains why the number of transactions has not started to grow back to previous levels yet.

Interest rates are a crucial factor in determining real estate prices due to the following reasons: Lower interest rates make financing more affordable, and when paired with high inflation—as observed recently—low returns on bank savings push investors towards alternatives to preserve their capital.

In our previous edition of the barometer dated 25th January 2024, we anticipated that central banks might reduce rates, as suggested by the inversion of the yield curve. We also highlighted specific pressures on the Swiss National Bank (SNB) to lower rates due to the strong Swiss franc adversely affecting exports and the comparatively low inflation in Switzerland. Our prediction proved accurate; the SNB took a proactive step by cutting its key interest rate from 1.75% to 1.5% on March 21st. However, the Fed and the ECB have maintained their rates at 5.25% and 4%, respectively, in their ongoing battle against inflation.

Currently, the yield curve remains inverted in both Switzerland and the Eurozone, signaling investor expectations that central banks will cut rates in the foreseeable future. UBS analysts predict that the SNB will implement two additional rate cuts in 2024.

Should these reductions occur, we anticipate a revival in both the volume of real estate transactions and property prices to levels observed before the recent economic shifts.

RealAdvisor SA

Rte de Saint-Julien 198,

CH-1228 Plan-les-Ouates

RealAdvisor AG

Heinrichstrasse 200

CH-8005 Zürich