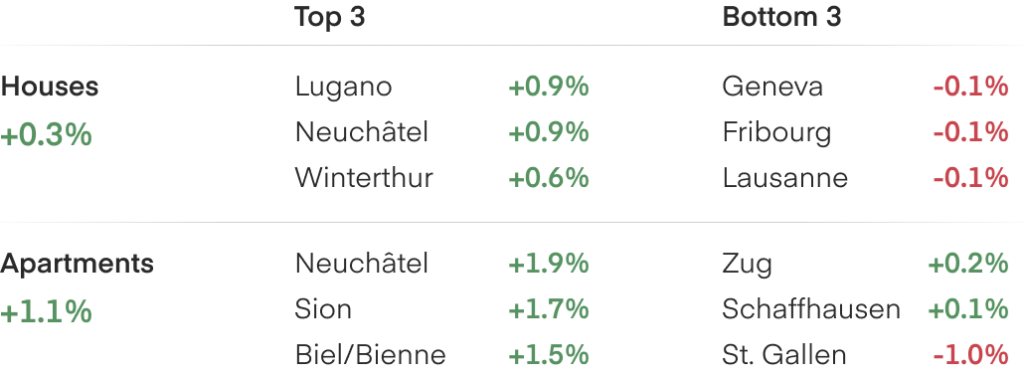

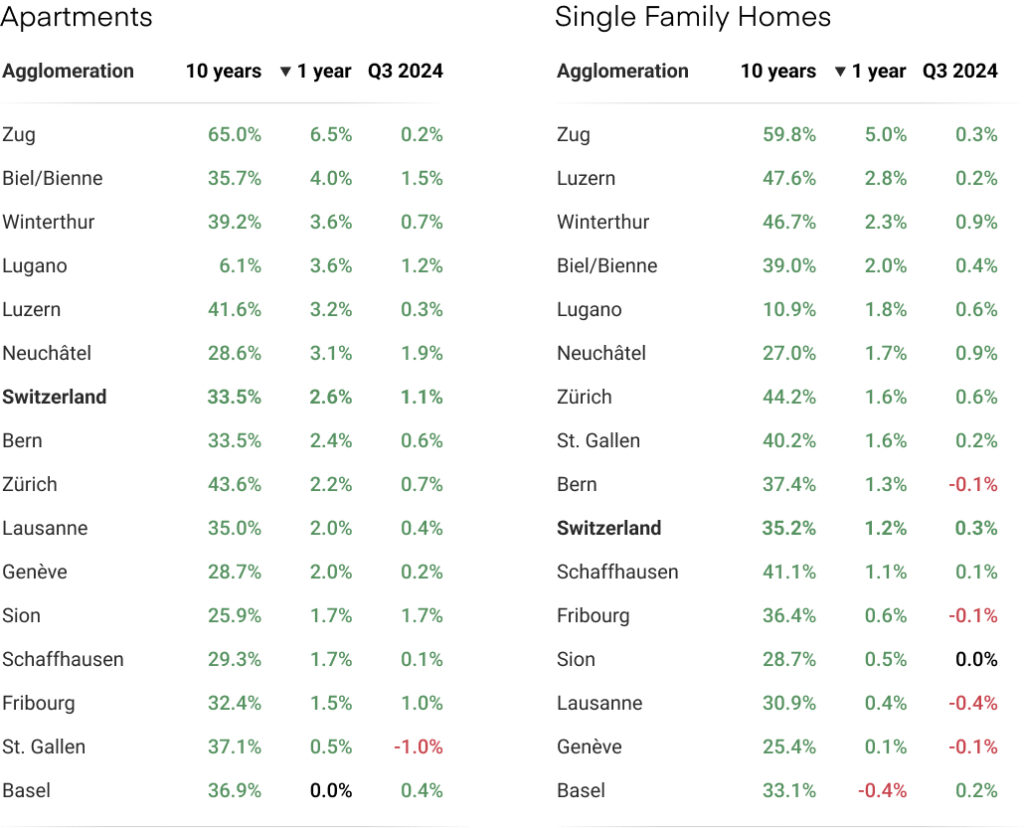

Q3 2024: Price changes in the 15 largest urban areas

Swiss real estate prices have risen for the third consecutive quarter, with apartments up +1.1% and houses up +0.3%. A -0.25% drop in the interest rate by the Swiss National Bank (SNB) has driven 10-year fixed mortgage rates to around 1.6%. Despite these positive indicators, transaction volumes remain at a five-year low, with recovery expected in the coming months.

The Swiss real estate market continued its steady recovery in Q3 2024, marking the third consecutive quarter of price growth. Both apartment and house prices increased, though at different rates. Apartment prices rose by +1.1% this quarter, while house prices registered a more modest gain of +0.3%. This trend indicates that property prices are gradually returning to their historical growth patterns after several years of volatility triggered by the COVID-19 pandemic.

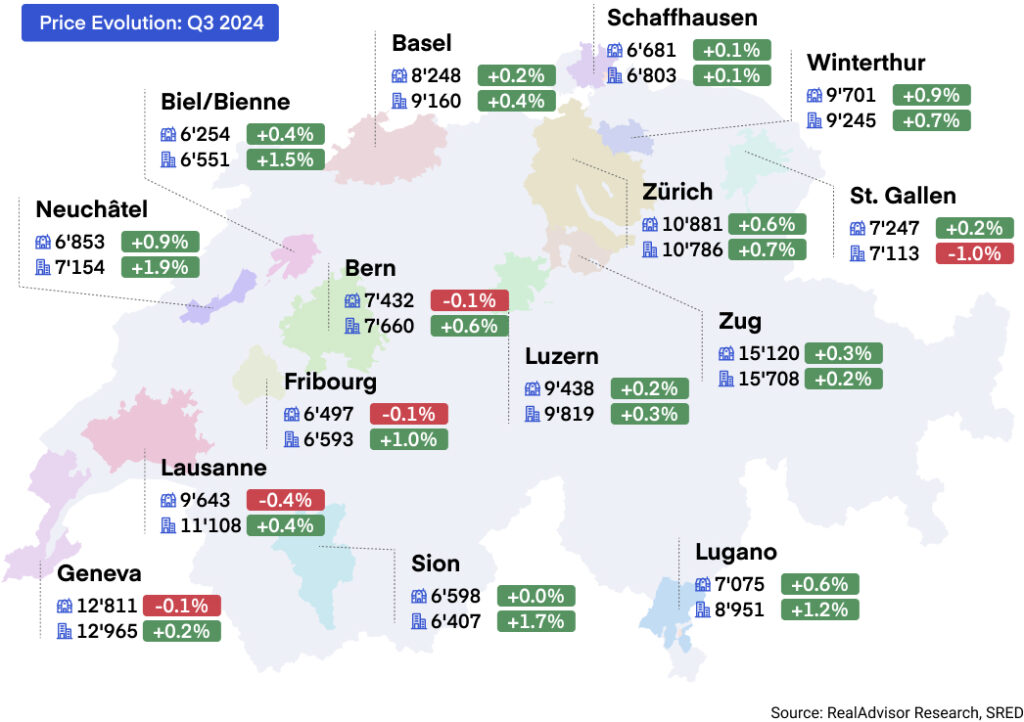

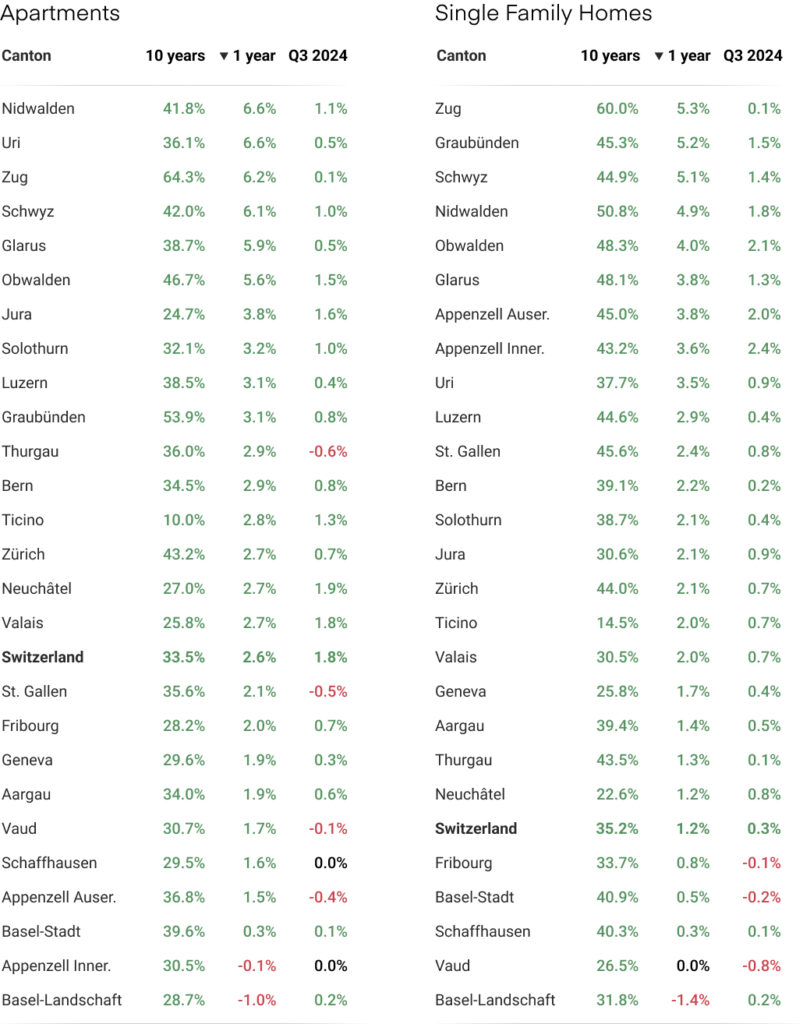

Apartment prices have continued to lead the recovery. A closer look at the data shows that prices have increased in all major agglomerations, except for St. Gallen, where a -1% decline was recorded. The strongest performers were Neuchâtel (+1.9%), Sion (+1.7%), and Biel/Bienne (+1.5%). In larger cities like Zürich, Bern, Lausanne, and Basel, growth has been slower, with increases ranging from +0.2% to +0.7%. This suggests that while demand remains strong in urban centres, more affordable and smaller markets have experienced sharper growth in apartment prices over the last three months. At the cantonal level, similar trends were observed, with some cantons outperforming others. Neuchâtel (+1.9%), Valais (+1.8%), and Jura (+1.6%) led the way, while cantons like Vaud (-0.1%), Appenzell Ausserrhoden (-0.4%), and St. Gallen (-0.5%) saw slight declines.

House prices, while growing more slowly than apartments, have also shown signs of recovery.Overall, house prices increased by +0.3% this quarter. However, major agglomerations in Romandie, such as Geneva (-0.1%), Fribourg (-0.1%), and Lausanne (-0.4%), saw price decreases. The top-performing cities were Winterthur (+0.9%) and Neuchâtel (+0.9%), followed by Zürich (+0.6%). At the cantonal level, the strongest growth in house prices was observed in Appenzell Innerrhoden (+2.4%), Obwalden (+2.1%), and Appenzell Ausserrhoden (+2.0%), with increases above +2%. Conversely, cantons like Vaud (-0.8%), Basel-Stadt (-0.2%), and Fribourg (-0.1%) experienced slight declines.

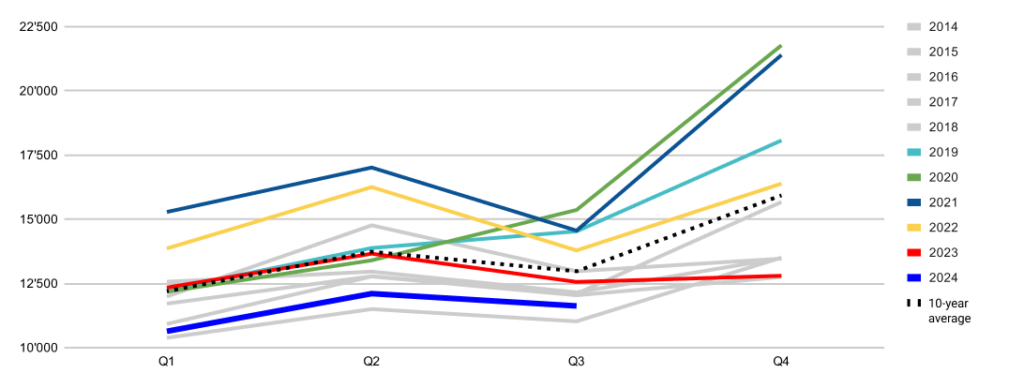

In Q3 2024, transaction volumes fell to their lowest level since 2017, showing a -10% decline compared to the 10-year average for this period. While the dip aligns with typical seasonal patterns, where Q3 tends to have slightly fewer transactions than Q2, it underscores a broader market slowdown.

Looking at historical trends, it's clear that the years from 2019 to 2021 were outliers, as Q4 saw unusually strong transaction volumes—largely driven by post-COVID market shifts and pent-up demand. Before the pandemic, Q4 had never been such a robust quarter. With the current dynamics in play, it seems unlikely that Q4 2024 will repeat those exceptional figures, and we may see a return to more subdued transaction levels typical of pre-2019 trends.

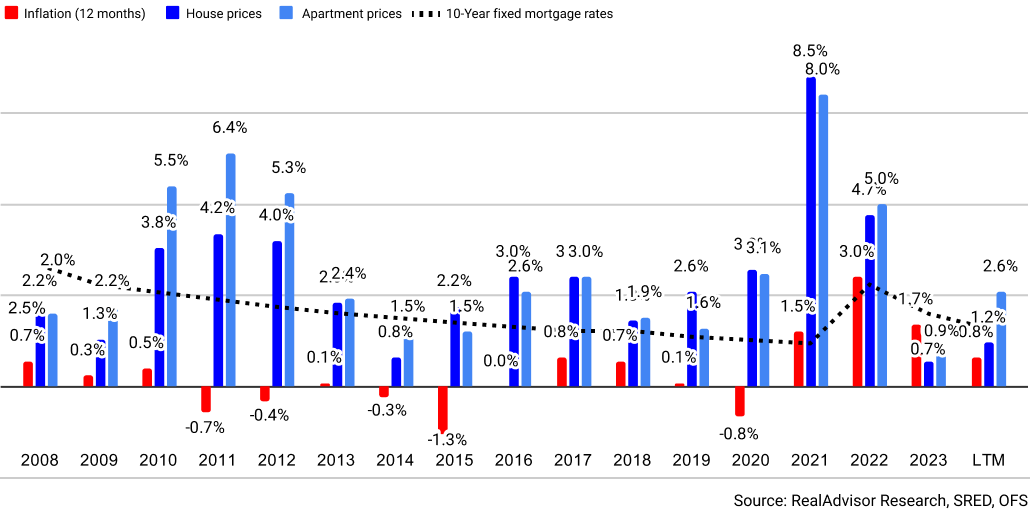

The U.S. Federal Reserve (FED) led the way with its first rate cut since 2020, reducing rates by 0.5%. Both the European Central Bank (ECB) and the Swiss National Bank (SNB) followed suit with -0.25% cuts. This brought the SNB's cumulative reduction to -0.75% following the sharp rate hikes between 2022 and 2023. Markets now anticipate an additional 25 basis point cut from the FED by year-end, which could further influence the SNB to reduce its key rate below 1%.

Consumer prices in Switzerland rose by 0.8% year-over-year in September, according to Switzerland’s statistics office, marking the smallest annual increase in three years and a decline from August’s 1.1% inflation rate. Given this downward inflation trend and SNB President Martin Schlegel’s comments that further rate cuts are "likely," markets expect the SNB to continue easing its policy.

These factors suggest that borrowing conditions will continue to improve, supporting property prices while preventing transaction volumes from dropping further. For homebuyers, although borrowing costs are expected to decrease slightly, the change in long-term rates is expected to be minimal. Forecasts suggest that the reduction in long-term mortgage rates may only be a few basis points. With property prices likely to keep rising, the fundamentals indicate that it is a good time to buy, as waiting could result in higher prices down the road.

RealAdvisor SA

Rte de Saint-Julien 198,

CH-1228 Plan-les-Ouates

RealAdvisor AG

Heinrichstrasse 200

CH-8005 Zürich