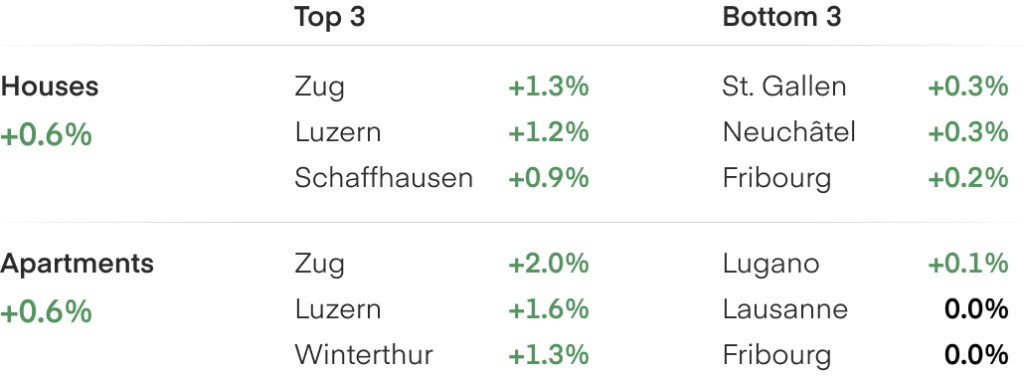

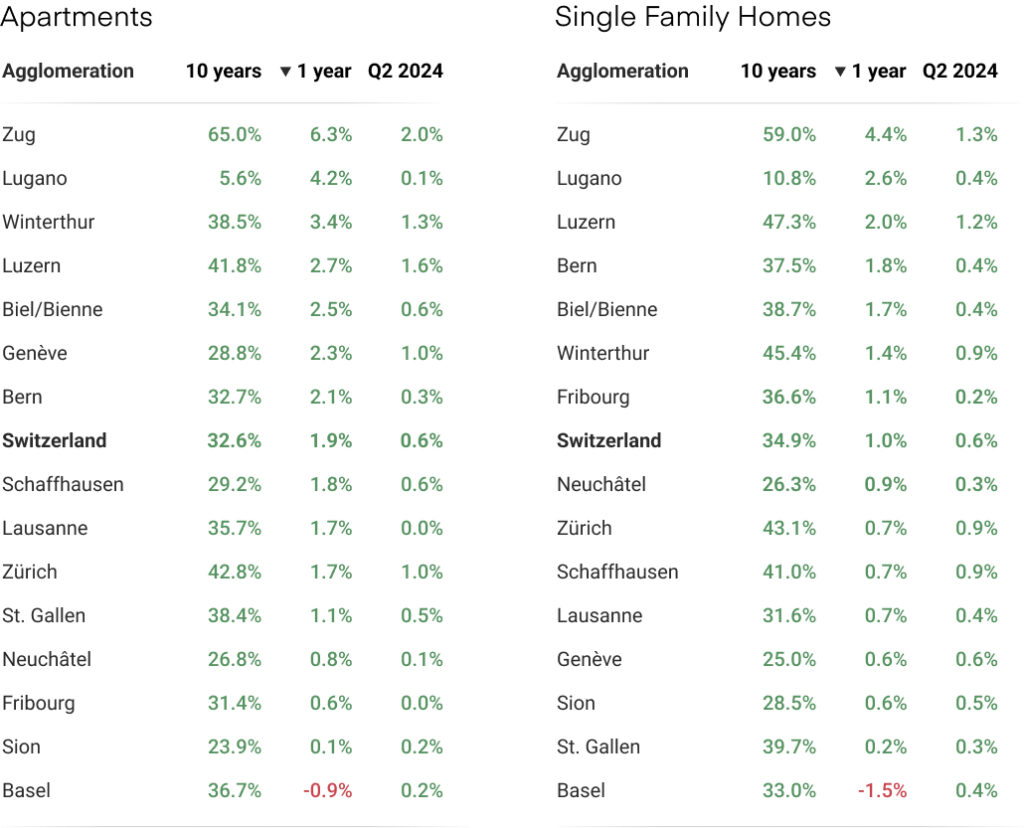

Q2 2024: Price changes in the 15 largest urban areas

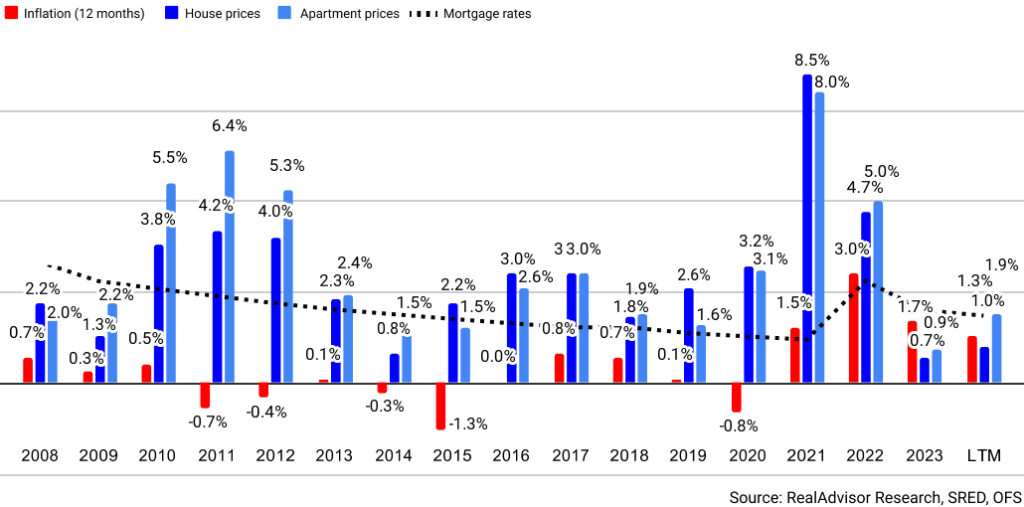

The Swiss real estate market experienced a significant recovery in the second quarter of 2024. Apartment prices increased by +1.9% year-over-year (YoY), and single-family home prices rose by +1.0% YoY, marking a stark contrast to a year ago when prices were declining nationwide. Despite the recent rate cuts in March that pushed prices up, the number of transactions has not seen a significant increase due to constrained supply. With another rate cut expected this year, the outlook for the real estate market is positive.

The Swiss real estate market has returned to growth, with an overall price increase of 1.9% for apartments and 1.0% for single-family homes YoY as of June. This recovery marks a significant turnaround from June 2023, when the market experienced declines of 0.8% for homes and 0.1% for apartments. The current trend of a 0.6% increase in prices for both houses and apartments over Q2 2024 suggests a steady movement towards the long-term average yearly growth rate of 3%.

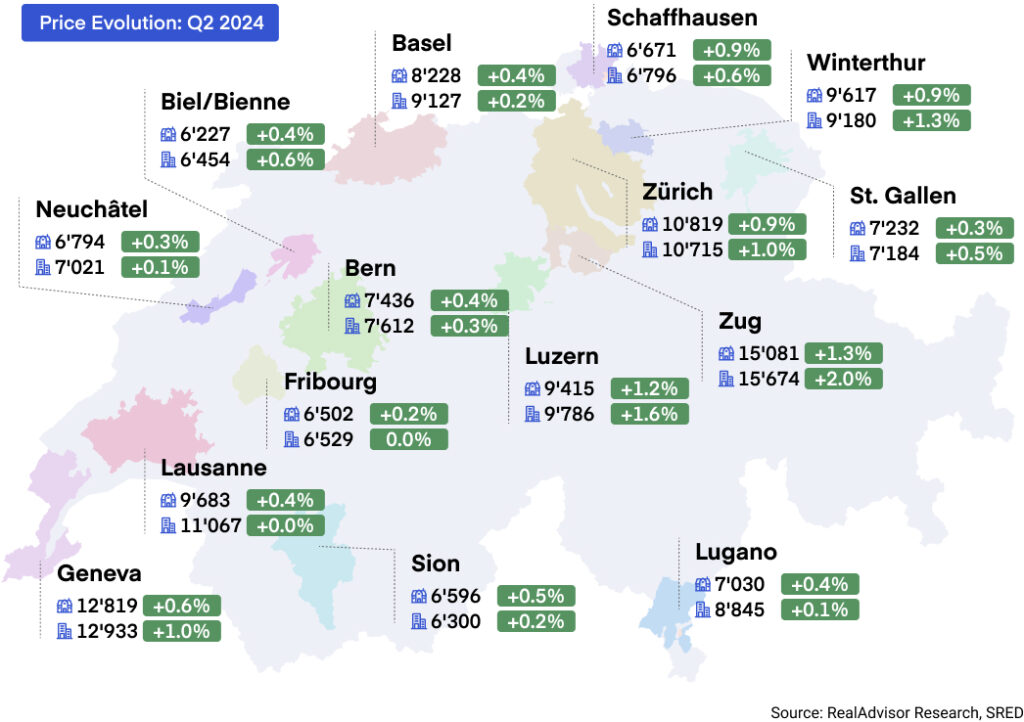

Prices have risen in all 15 major agglomerations across Switzerland this quarter. Apartments saw a +1% increase in Zurich, a +1% increase in Geneva, and a modest +0.2% increase in Basel. For houses, Zurich saw a +0.9% rise, Geneva +0.6%, and Basel +0.4%. Notably, cities with lower taxes continue to outperform others: Zug experienced a +2% increase for apartments and +1.3% for houses, while Lucerne saw a +1.6% increase for apartments and +1.2% for houses. Basel remains the only city where prices are lower than a year ago.

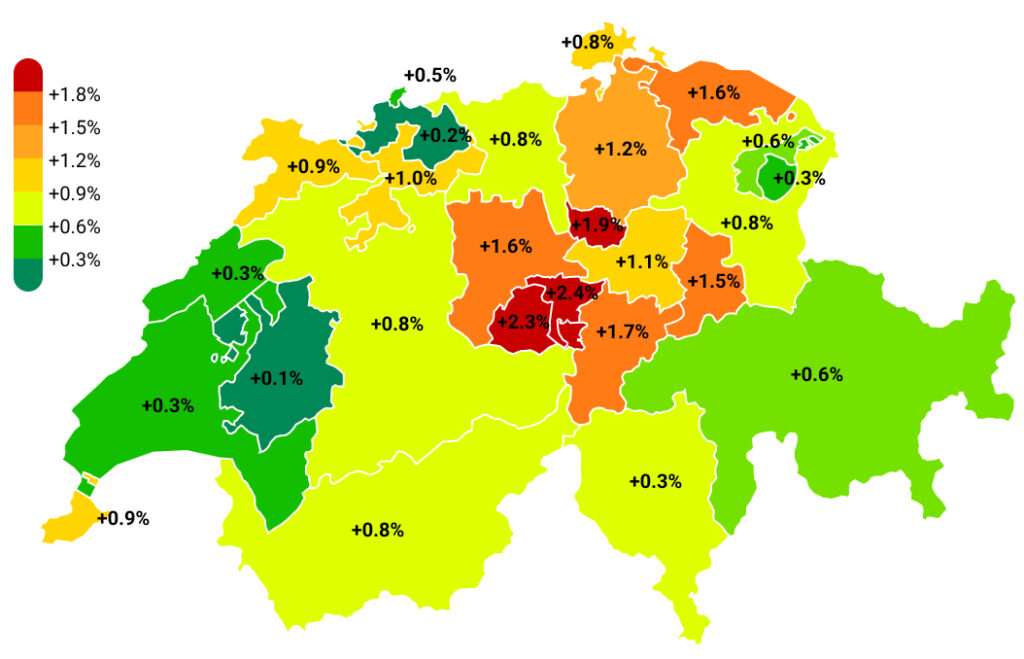

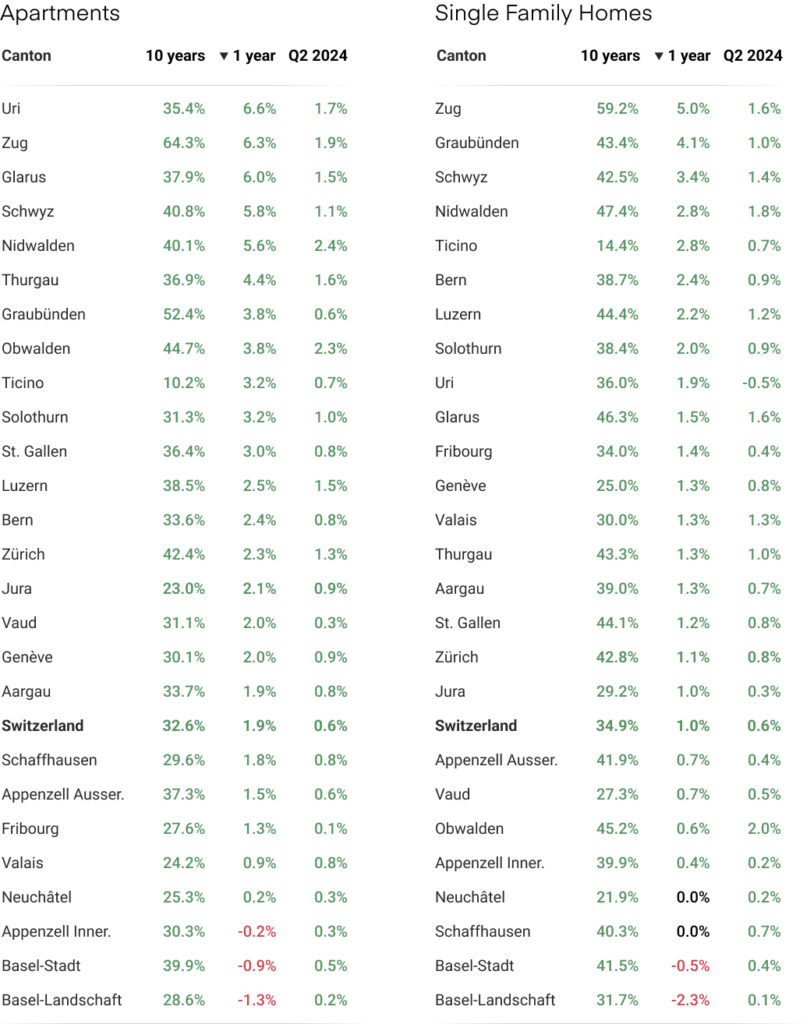

Similar trends are observed at the cantonal level, with price increases across every canton this quarter. Low-tax cantons in central Switzerland around Zurich continue to outperform others. For houses, Obwalden led with a +2.0% increase, followed by Nidwalden with +1.8%, Zug and Glarus each with +1.6%, Uri with 1.4%, Lucerne with +1.2%, and Thurgau with +1.0%. For apartments, Obwalden saw a +2.3% increase, Nidwalden +2.4%, Zug +1.9%, Glarus +1.5%, Uri +1.7%, Lucerne +1.5%, and Thurgau +1.0%.

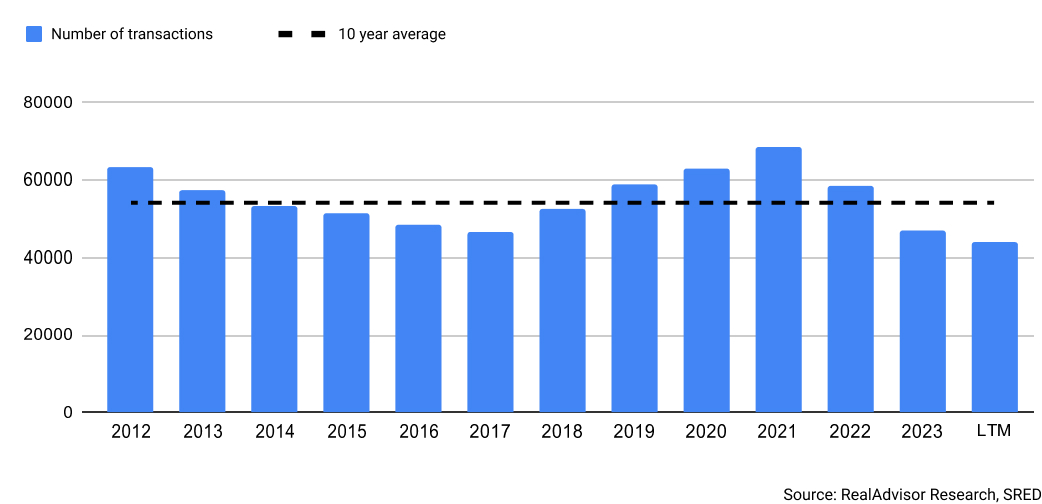

Transaction volumes remain lower than 12 months ago. Despite the recent rate cuts in March pushing prices up, the number of transactions has not seen a significant increase due to constrained supply. Statistics from the cantons of Zurich and Geneva reveal a -4.7% drop in transactions in Geneva and a -6.6% drop in Zurich for 2023. Our estimates indicate that the overall number of transactions is still lower than last year. The number of homes on the market has not increased, and we do not expect this trend to change in the coming months.

Leading indicators, such as construction permits issued, suggest that the number of new constructions will not rise soon. Although lower interest rates may facilitate buyers meeting sellers' expectations, the impact on transaction numbers has not been significant yet. However, we anticipate that transaction numbers will start climbing back to normal in the second half of the year as the market adjusts. The lower interest rates will make it easier for buyers to meet price levels and increase the number of prospective buyers in the market, potentially normalizing transaction numbers by the year's end.

As predicted in previous reports, the drop in interest rates in March has driven up prices across all regions this quarter. We expect the number of transactions to stabilize and then start climbing back to historical averages.

Interest rates are likely to continue falling, with the market anticipating further cuts by central banks. The ECB reduced its rate in June for the first time since 2019, from 4% to 3.75%. Conversely, the FED has yet to make a move, with inflation in the US still 1% above the 2% target. Analysts predict the FED will cut rates in September.

For Switzerland, initial predictions for three rate cuts this year now seem overly optimistic. The Swiss National Bank (BNS) is likely to cut rates no more than once more this year, further lowering mortgage rates and making homeownership more attractive. Ten-year fixed rates could fall below 1.9%.

Political shifts in Europe also favour Switzerland as an attractive destination for wealthy individuals. The UK’s abandonment of non-dom status and the election of a Labour Prime Minister, along with France's legislative election results showing gains for far-right and far-left parties, may drive companies and individuals to seek the stability and favourable fiscal environment of Switzerland.

Overall, all indicators suggest continued price increases and a rise in transaction volumes in the coming months.

RealAdvisor SA

Rte de Saint-Julien 198,

CH-1228 Plan-les-Ouates

RealAdvisor AG

Heinrichstrasse 200

CH-8005 Zürich