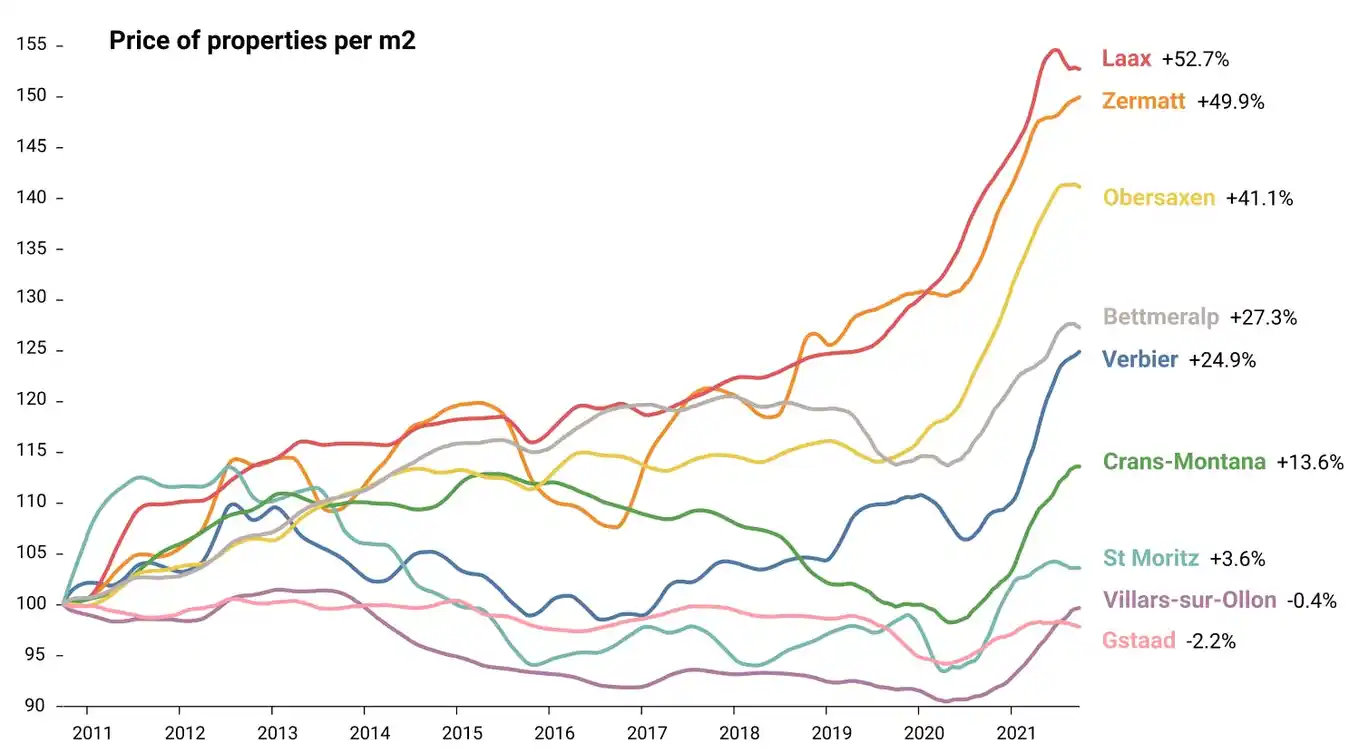

Prices in Swiss resorts have been growing steadily since 2019: 13.8% despite the pandemic. After a downward trend in prices per square meter after 2012 in some resorts such as Crans-Montana, Villars-sur-Ollon, and St. Moritz, they have been experiencing an upturn in property value. In general, the average price per square meter when purchasing apartments and houses in Swiss resorts has increased by 23.3% since 2011. Such significant growth over the last two years can be observed in relation to both the ‘upmarket’ resorts and the more affordable ones. However, there are differences in the factors behind such increases.

The demand for apartments and houses in resorts has been increasing significantly over the past two years. The context, particularly with reference to the pandemic and associated restrictions, may well have strengthened the desire for a second home in Switzerland, for both Swiss people as well as foreigners. In this context, some households were able to save money to finance the purchase of a property, especially so against the backdrop of low-interest rates encouraging investment rather than saving.

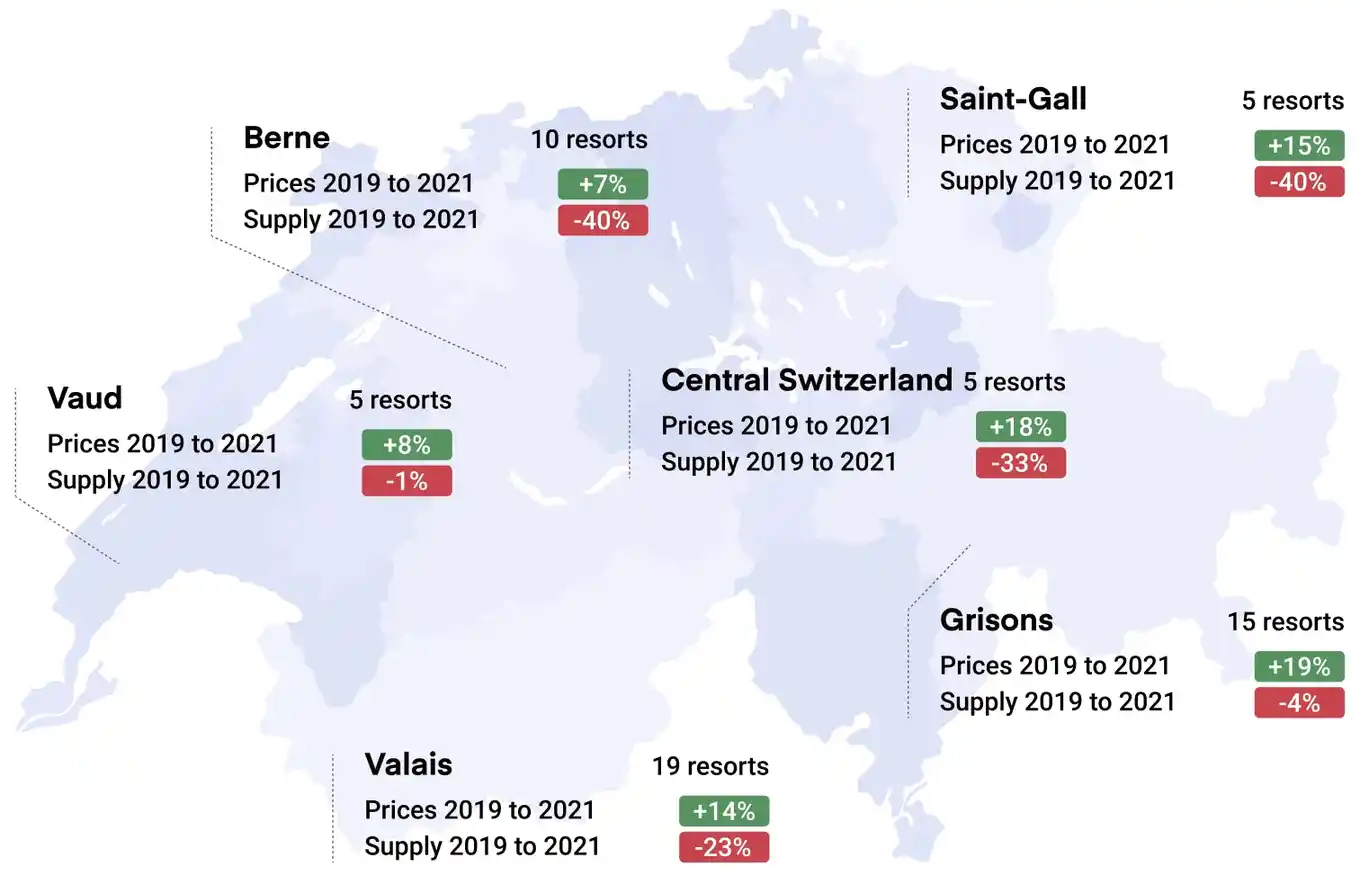

This relationship between strong demand and notoriously limited supply has rapidly saturated the available units: the number of advertisements for properties located in Swiss ski resorts fell by 20% between the third quarter (Q3) 2019 and 2021. Therefore, this scarcity of supply was reflected in prices, driving them upwards.

All Swiss ski resorts saw their prices increase between 2019 and 2021, on average by 13.8%.

However, this acceleration has been particularly marked in the canton of Grisons, where the eight resorts which experienced the strongest growth over the past two years are located.

This impressive increase needs to be considered in relation to the already historic growth in property prices experienced throughout Switzerland: + 5.2% for apartments and + 6.2% for villas over the first 9 months of 2021.

This concentration in the Grisons is likely to be the crystallization of a trend, i.e., the quicker increase in prices in the central and eastern cantons over the last ten years. Indeed, the cantons of Uri, Lucerne, Obwalden, and St. Gallen saw the average prices of some of their resorts increase by 40%, an increase almost twice the average across Swiss resorts (23.3%) between 2011 and 2021.

Resorts in western Switzerland, instead, are experiencing lower than average growth, of 20.7% in Valais and 19.3% in Bern.

As regards the resorts of Canton Vaud, they experienced the lowest increase over the last ten years, of 7.5%, despite the cantons of Vaud and Valais featuring the strongest performances between 2000 and 2010.

Furthermore, the resorts in Grisons enjoy international media exposure with the World Economic Forum in Davos and St. Moritz enjoys an image as the second most expensive resort in Switzerland.

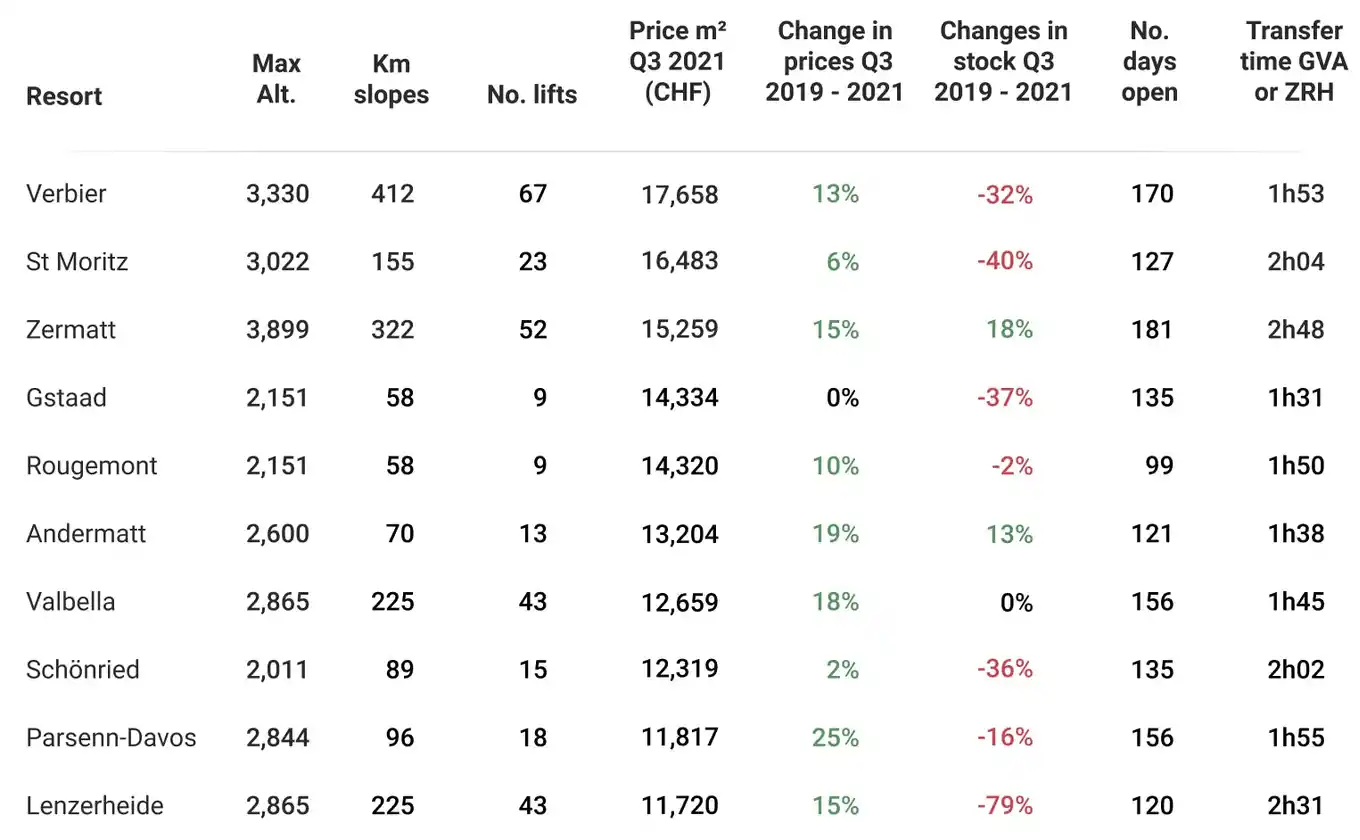

The analysis of the attractiveness variables for the most expensive resorts reveals that the factors traditionally associated with skiing remain correlated with price growth, even in a world in the grip of a pandemic.

Thus, among the twenty most expensive resorts per square meter in 2021, those with ski areas at the highest altitude (in relation to the summit) also tend to be those which experienced the most significant growth over the last ten years. The same correlation can be observed with the number of ski lifts, the number of kilometers of slopes, the annual opening period of the ski area, and accessibility from Zurich or Geneva airport.

The average annual rental value for a three-bedroom property in Zermatt was CHF 51,053 in 2020, according to AirDNA information*. This rental value is unevenly distributed over the year, amounting to CHF 10,451 in February, while in June of the same year income from rentals was CHF 3,895.

However, the average monthly income was CHF 4,155 in September 2020, reaching CHF 5,391 in September 2021, showing a growing demand for the rental of properties in Zermatt, whose ski area is open 181 days a year. Thus, the rental value represents between 2.5% to 3.5% of gross return for most of these large resorts. This allows owners to cover a significant portion of their costs by renting their property a few weeks a year, especially during the high season. In turn, such a high income from renting an apartment or a house shows the appeal of a stay in these resorts, especially for skiing.

* AirDNA data (www.airdna.com)

These resorts are all the more popular as they offer additional leisure activities alongside skiing. For example, Zermatt is also known for its wellness infrastructure and the many bars and clubs available for après-ski.

As regards supply, these resorts have experienced a reduction of 36.8% over the past two years, compared to an average of around 20%. The low number of available properties, as well as the weaker liquidity characterizing prestige properties, explains such a sharp drop.

Iconic high-end resorts enjoy continued attractiveness, which results in their stability in the ranking of the twenty most expensive resorts. Therefore, among the top 20 most expensive resorts per square meter in Q3 2021, the first eighteen already qualified in Q3 2019. Whereas over the last two years Scuol - Motta Naluns and Mythenregion replaced Villars-sur-Ollon and Champéry.

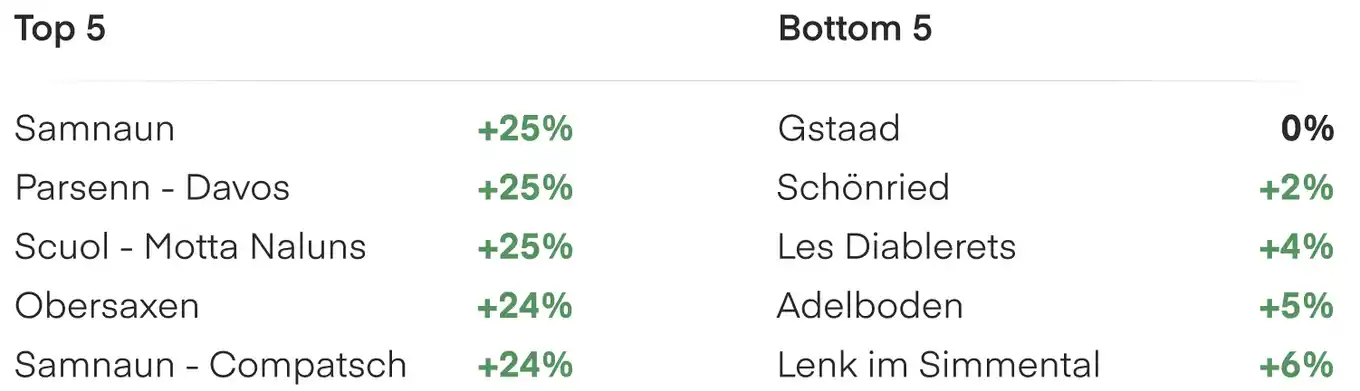

Overall, the prices of the top resorts increased from CHF 10,730/m² to CHF 12,215/m² in two years. However, not all of these major resorts experienced the same growth. While resorts in Grisons like Parsenn-Davos, Scuol-Motta Naluns, Falera, Arosa, Laax, and Obwalden including Engelberg have appreciated by more than 21% over the period, Gstaad, Schönried, and St. Moritz saw a growth of between 0 and 6%.

Resorts such as Gstaad, Verbier, and St. Moritz have a large number of permanent residents, partially due to the fact that they play host to private schools. Indeed, many students and their families, in addition to school staff, have their primary or secondary residences there.

Furthermore, they offer many sporting and cultural events throughout the year, such as the Engadine Skimarathon, the Patrouille des Glaciers from Zermatt to Verbier, or the Swatch Beach Volleyball Major in Gstaad.

Resorts such as Gstaad and St. Moritz seem to attract more people wishing to become residents rather than buying a second home. This is likely to explain the lower demand and the less marked increase in prices per square meter.

While the most affordable resorts have experienced price growth comparable to that of high-end resorts since 2019 (+ 13.8% versus 14.1%), the key factors behind their growth appear to be different.

Firstly, it appears that there, the supply of properties has not experienced a drop comparable to that in the most expensive resorts between 2019 and 2021. In fact, the number of real estate adverts decreased only by 13.2% against 36.8%.

A similar rise in the price per m², associated with a smaller drop in supply compared to more expensive resorts, results in an even greater demand for chalets and apartments in more affordable resorts. Such strong demand can be explained principally by the fact that some buyers tend to settle for more affordable resorts for financial reasons, but also due to the lack of availability of properties to buy in more high-end resorts.

Moreover, it would appear that these resorts enjoy a distinct demand. Their price growth does not appear to be linked solely to the size and attractiveness of their ski area.

From 2019 to 2021, the smaller the ski area of the affordable resorts, the lower the altitude, the less equipped with ski lifts, and with reduced opening days, the bigger was the increase in prices during the pandemic.

This data is perhaps counter-intuitive and raises questions. It may simply indicate a catching up in the valuation of the most accessible properties in the face of a demand shock.

However, where the price growth in the most affordable resorts does not match the variables associated with the ski area, this may be explained by the fact that buyers are not only looking for downhill skiing but more and more for access to a second home (whether permanent or semi-permanent) close to nature, quickly accessible with the family, to also engage in other sports, such as hiking and cross-country skiing.

By comparison, the French national turnover of cross-country ski areas doubled over the 2020-2021 season to reach EUR 19.4 million*.

On the other hand, the price of the most affordable stations retains the same ratio as the most expensive stations in terms of transfer time from the airports of Zurich and Geneva, if not even more pronounced.

Furthermore, with the increased flexibility of working from home due to the health crisis, more and more people are looking to purchase a property in the resorts to exploit throughout the year, hence the increased importance of rapid access from large urban centers in Switzerland.

Therefore, there seems to be a change in the profile of buyers, and their motivations, in resorts providing access to the benefits of the mountain, and not only in relation to skiing.

* “Historic increase in the activity of cross-country skiing in 2020-2021”

Published by Les Echos on 29 April 2021

RealAdvisor is the commercial brand of the legal entity "AI Partners SA", a limited company headquartered in Geneva.

RealAdvisor

c/o AI Partners SA

Avenue Louis-Casaï 86A

1216 Cointrin

Switzerland